Trade War Effect: Uncertainty Rises

As earnings season gets underway, it's becoming increasingly clear that uncertainty caused by the ongoing tariff standoff is weighing on both business activity and consumer sentiment.

Big Companies Are Adjusting Expectations

Despite the optimism in the markets, some big U.S. corporations are revising their forecasts. Procter & Gamble (PG.N), PepsiCo (PEP.O), Chipotle Mexican Grill (CMG.N) and American Airlines (AAL.O) all said they were changing or withdrawing their guidance, citing growing uncertainty in the consumer environment.

PepsiCo and P&G under pressure

Shares in the consumer giants responded by falling, with Procter & Gamble down 3.7% and PepsiCo down 4.9%, reflecting growing concerns about a slowdown in consumer spending.

ServiceNow hits records amid AI boom

Meanwhile, ServiceNow (NOW.N) delivered impressive results, beating analysts expectations thanks to continued demand for its AI solutions. The company's shares soared 15.5%, becoming one of the brightest stars of the day.

Hasbro Surprises Markets

Investors were also pleased with Hasbro (HAS.O) earnings, with strong gaming sales beating Wall Street forecasts and sending the company's shares up 14.6%.

More than 70% of companies are pleased with their results

Of the 157 S&P 500 companies that have already reported their quarterly results, 74% have performed better than expected, according to LSEG. The expected annual earnings growth for the entire index is now estimated at 8.9%, up from the 8.0% forecast made earlier this month.

The economy is holding up well

New durable goods orders beat expectations and jobless claims data remained stable, painting a picture of an economy that remains resilient even amid global challenges.

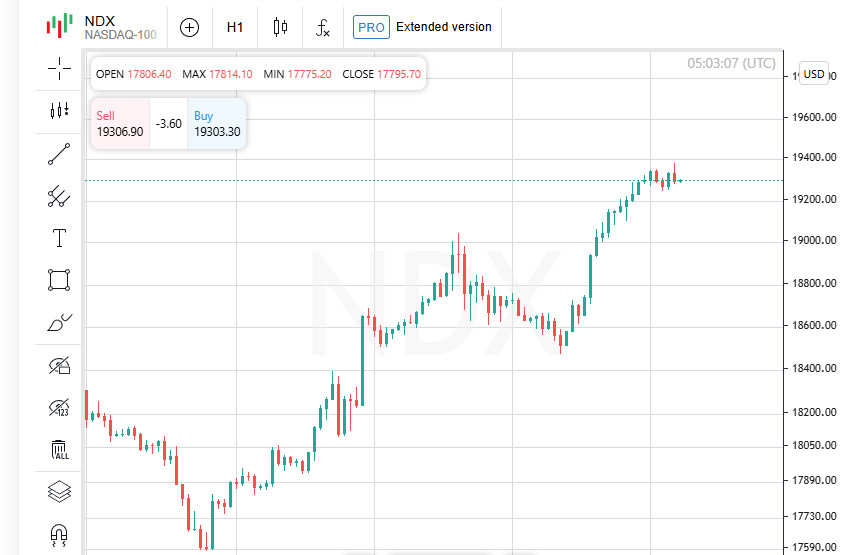

Indices soar

Amid the positive news, the main US stock indices rose confidently: the Dow Jones added 486.83 points, or 1.23%, to reach 40,093.40. The S&P 500 rose 108.91 points, or 2.03%, to close at 5,484.77. The Nasdaq Composite was the leader, jumping 457.99 points, or 2.74%, to 17,166.04.

Alphabet Leads the Way: Explosive Growth After Strong Earnings

Tech giant Alphabet (GOOGL.O), the owner of Google, beat analysts earnings estimates on Monday while reaffirming its ambitious plans to invest in artificial intelligence. The news sent shares of the company up nearly 5% in after-hours trading and helped fuel gains not only among its tech peers but also in S&P 500 futures, which added 0.5%.

Tech Leads Wall Street Gains

Of the 11 major S&P 500 sector indices, nearly all ended higher, with the exception of the consumer staples sector (.SPLRCS). The technology sector (.SPLRCT) posted the biggest gain, up 3.5%, underscoring growing investor appetite for tech companies.

Market rally: Growth dominates

On the New York Stock Exchange, there were nearly six gainers for every one that fell, a ratio of 5.84 to 1. There were 50 new 52-week highs versus 30 new lows, indicating a strong positive sentiment.

On the Nasdaq, bulls also dominated, with 3,401 shares advancing and 1,005 falling, for a ratio of 3.38 to 1 in favor of gainers. However, the dynamics of new highs and lows in this market were more mixed, with 40 new highs versus 51 new lows.

Turnover below average

Despite the strong price action, overall trading volume was below average, with about 14.95 billion shares traded on U.S. exchanges on Thursday, below the typical 20-day volume of 19.15 billion shares.

Asia Rises in Optimism

As the rhetoric between the US and China eased, Asian stock markets also posted solid gains on Friday, aiming for a second straight week of gains. Meanwhile, the dollar posted its first weekly gain in more than a month, reflecting a modest recovery in confidence among global investors despite the lack of concrete agreements between the two economic superpowers.

Dollar Seeks Support After Turbulent Weeks

After weeks of volatility on trade news, the US currency is finally showing signs of stabilization. On Friday, the dollar held its ground around $1.1350 per euro and 143 yen, while dollar selling eased in Asian markets.

Trade War Changes Script

After a protracted period of mutual tariff strikes that effectively paralyzed trade between the US and China, Washington changed its rhetoric this week, allowing for a more flexible approach. However, Beijing has cooled its enthusiasm, stressing that there were no formal talks despite statements by US President Donald Trump, and warned other countries against entering into deals that infringe on China's interests.

Japanese market recoups losses

Amid softening US tariff threats, the Nikkei index (.N225) gained 1.4% on Friday, fully recovering its previous losses. Recall that the market's sharp decline began after Trump announced in early April the highest import tariffs in a century, most of which were eventually frozen - with the exception of restrictions on China and a basic 10% duty.

Tech giants lead the rise in Japan

Tech stocks were among the leaders, with shares of electric motor maker Nidec (6954.T) jumping 11% amid a forecast of record annual profit. Shares in automaker Nissan (7201.T) also rose 2% as investors expressed cautious optimism despite the company's expected record net loss.

Positivity spreads across Asian markets

Asian stock markets generally ended the week on a positive note. Hong Kong's Hang Seng Index (.HSI) added 0.9%, while key Chinese indices – the Shanghai Composite (.SSEC) and CSI300 (.CSI300) – also posted small but solid gains, supporting the overall trend of rising investor sentiment in the region.

Dollar strengthens, but concerns remain

The US dollar index ended the week up 0.4%, settling at 99.619. Despite the local strengthening of the American currency, investors remain wary, sensing that the period of relative stability may not last long.

Holiday Pause in Australia and New Zealand

Stock markets in Australia and New Zealand were closed on Friday for national holidays, dampening overall activity on Asian markets. However, even with trading volumes subdued, experts pointed to numerous signs of potential volatility in the near future.

Gold Warns of Market Sentiment

Gold prices are holding high at around $3,349 an ounce. Philip Securities analysts in Singapore note that the Gold / S&P 500 ratio, traditionally seen as a proxy for investment anxiety, has hit its highest since the 2020 pandemic crash. This signals growing concerns among market participants.

Treasury Bonds Under Pressure

The US Treasury market continues to be under pressure. The massive sell-off in Treasuries has worsened amid Donald Trump's tariff rhetoric, which has shaken investor confidence in US assets. The yield on 10-year bonds was 4.3168% on Friday, reflecting a general mood of caution and risk aversion.