Trade Analysis and Tips for Trading the British Pound

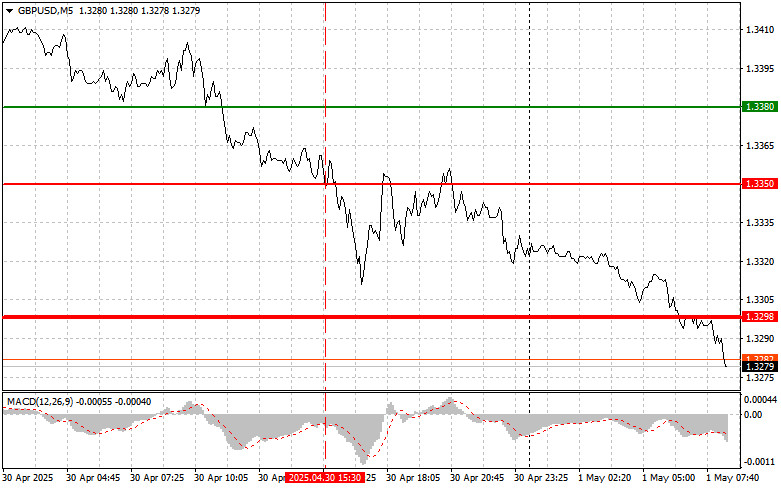

The test of the 1.3350 price level in the second half of the day coincided with the MACD indicator having already moved significantly below the zero mark, which limited the pair's downward potential. For this reason, I did not sell the pound and missed out on a good downward move.

Initial forecasts from the U.S. government indicated real GDP growth, but in fact, the U.S. economy contracted by 0.3% year-over-year. Nevertheless, the U.S. dollar did not react to this data and continued to strengthen against the pound. A similar reaction occurred with the weak ADP report reflecting the state of the U.S. labor market.

Today, further support for the pound may come from UK Manufacturing PMI data, the number of approved mortgage applications, and changes in the M4 money supply aggregate. Economic indicators reflecting the state of British industry serve as an important barometer for investors. PMI exceeding expectations may signal a revival in the manufacturing sector, which would positively affect market sentiment and support the pound. However, considering the current condition of the UK manufacturing sector, it will be rather difficult for buyers to rely on this indicator.

In turn, an increase in the number of approved mortgage applications points to growing activity in the real estate market, which is a sign of a healthy economy. This could also help strengthen the pound as it reflects consumer confidence in the country's economic outlook.

Finally, changes in the M4 money supply — a broad measure of money in circulation — may influence inflation and, as a result, the exchange rate.

As for intraday strategy, I will continue to rely primarily on the implementation of Scenarios #1 and #2.

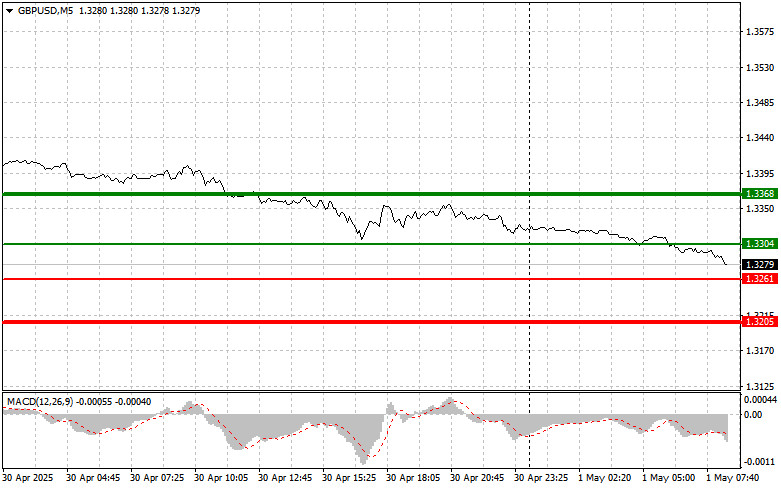

Buy Scenarios

Scenario #1: Today, I plan to buy the pound upon reaching the entry point around 1.3304 (green line on the chart) with the goal of rising to the 1.3368 level (thicker green line on the chart). Around 1.3368, I plan to exit long positions and open short positions in the opposite direction (expecting a 30–35 point move in the opposite direction). Relying on pound growth today is only possible after strong data. Important! Before buying, make sure the MACD indicator is above the zero mark and just beginning to rise from it.

Scenario #2: I also plan to buy the pound today in the case of two consecutive tests of the 1.3261 level while the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a market reversal upward. A rise toward the opposite levels of 1.3304 and 1.3368 can be expected.

Sell Scenarios

Scenario #1: Today, I plan to sell the pound after a breakout below the 1.3261 level (red line on the chart), which will likely result in a quick decline in the pair. The key target for sellers will be 1.3205, where I plan to exit sales and immediately open long positions in the opposite direction (expecting a 20–25 point move in the opposite direction). Selling the pound is viable after weak data. Important! Before selling, make sure the MACD indicator is below the zero mark and just beginning to fall from it.

Scenario #2: I also plan to sell the pound today if there are two consecutive tests of the 1.3304 level while the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. A decline toward the opposite levels of 1.3261 and 1.3205 can be expected.

What's on the chart:

- Thin green line – the entry price at which the trading instrument can be bought.

- Thick green line – the assumed price where Take Profit can be placed or profits manually secured, as further growth above this level is unlikely.

- Thin red line – the entry price at which the trading instrument can be sold.

- Thick red line – the assumed price where Take Profit can be placed or profits manually secured, as further decline below this level is unlikely.

- MACD indicator – when entering the market, it is important to be guided by overbought and oversold zones.

Important. Beginner Forex traders must be very cautious when making decisions about entering the market. Before the release of important fundamental reports, it's best to stay out of the market to avoid getting caught in sharp price swings. If you decide to trade during news releases, always set stop-loss orders to minimize losses. Without stop-losses, you can very quickly lose your entire deposit, especially if you don't use money management and trade large volumes.

And remember, for successful trading, you need a clear trading plan — like the one I've presented above. Making spontaneous trading decisions based on the current market situation is by default a losing strategy for intraday traders.