The upcoming week will be rich in important economic data releases, which could have a noticeable impact on market dynamics — but will they be able to?

Amid the geopolitical chaos generated by Donald Trump, which is shaping an overall picture of uncertainty regarding the likely development of both the American and global economies, investors may try this week to use the publication of key data from the U.S., the Eurozone, and China to better understand what to expect in the near future.

Indeed, what should we pay attention to this week? First and foremost, the focus will be on the release of U.S. employment and inflation figures, manufacturing indicators from China and the U.S., and consumer inflation in the Eurozone. GDP reports from the Eurozone and the U.S. will also be of significant interest.

Starting with U.S. news, according to consensus forecasts, the number of new jobs created in April, according to ADP, will be noticeably lower than in March—only 123,000 in April compared to 155,000 a month earlier. Likewise, the number of new jobs reported by the U.S. Department of Labor is forecasted to fall significantly to 129,000 in April from 228,000 in March.

The forecasts are certainly pessimistic and should already reflect the negative realities resulting from Trump's global trade wars. In addition, the forecasted GDP growth for the first quarter of this year is expected to fall from 2.4% to 0.2%. At the same time, the Eurozone's GDP is expected to remain within a statistical margin of around 1.0%.

As for manufacturing indicators, a slight increase is expected in April for the Manufacturing Purchasing Managers' Index (PMI) from 50.2 points to 50.7 points. However, the value of the same indicator from the Institute for Supply Management (ISM) is expected to decline to 48 points from 49. Figures from China are also not expected to bring much optimism. The local PMI is projected to slow down in April from March's reading of 50.8 points to 49.8 points. A minor increase from 48.6 points to 48.7 in the eurozone is expected, but it is unlikely to play any significant role.

Now, to the important inflation data. This week, the inflation report from the eurozone will draw attention. In April, the core consumer price index (CPI) is expected to increase slightly in annual terms, from 2.4% to 2.5%, while the overall CPI figure is expected to decline from 2.2% to 2.1%.

And the highlight of the week will undoubtedly be the inflation reports from the United States. This concerns the April reading of the Personal Consumption Expenditures (PCE) Price Index and its core measure. A decrease is projected here: the core year-over-year figure is expected to fall to 2.5% from 2.8% and the overall figure to 2.2% from 2.5%. Personal spending is expected to rise from 0.4% to 0.6%, while incomes are projected to drop from 0.8% to 0.4%.

So, how might the markets react to such a large flow of generally negative news?

It is important to acknowledge that the uncertainty driven by Trump may once again negate the impact of this news. However, overall, data from America, China, and Europe points to the negative effects of trade wars, which could force the opposing sides to more actively seek compromises — a positive sign for demand for risk assets. The slowdown in inflation in the Eurozone may compel the European Central Bank to cut rates by another 0.25%, which would negatively affect the euro, though only partially. Meanwhile, a decline in inflation in the U.S., as I have previously argued, could lead the Federal Reserve to resume cutting rates as early as May or June, which would weaken the U.S. dollar on the Forex market.

Overall, the decline in Treasury yields positively affects market sentiment and suggests that markets expect a favorable reaction this week. The rebound of stock indices worldwide also reflects high investor hopes for tariff compromises between Beijing and Washington. We might also see weaker U.S. employment data push the dollar back into decline. The dollar index could fall below the 98.00 mark on the back of inflation reports.

Strangely enough, this week will likely be positive for buying stocks and cryptocurrencies while putting selling pressure on the dollar in the Forex market and on gold.

Forecast of the day:

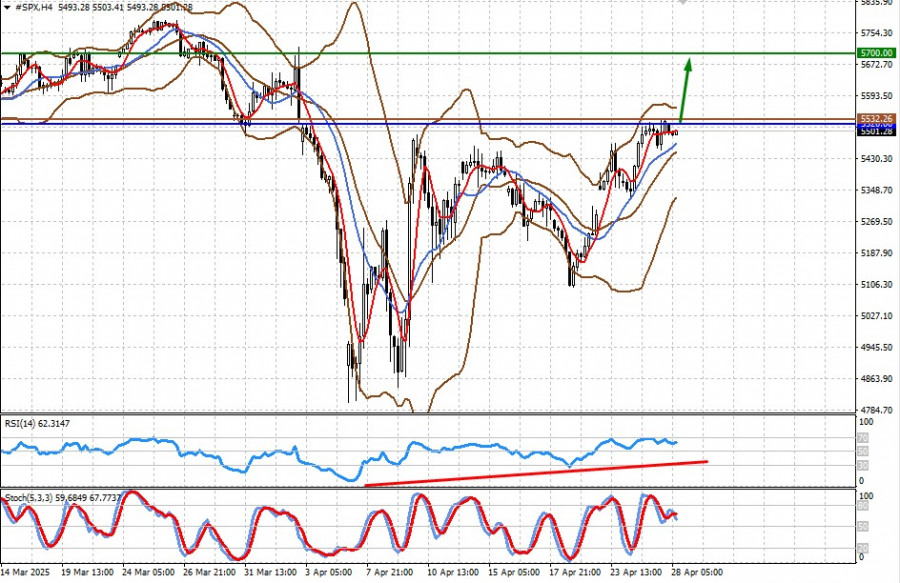

#SPX

The CFD contract on the S&P 500 futures trades below the resistance level of 5520.00. Breaking above this level, supported by the developments outlined in the article, could lead to further growth toward the 5700.00 mark. The entry point for buying could be the 5532.26 level.

Bitcoin

The token saw significant gains last week amid hopes of ending the U.S.-China trade war. It may continue to rise against the overall positive backdrop this week. A breakout above the 95000.00 resistance level could serve as a basis for a further rise toward 99400.00. The entry point for buying could be the 95659.57 level.