Investors Lose Confidence as Markets Fall as Trump Presses Fed

Asian stock markets and US futures opened the week with significant losses, reflecting growing concerns amid political pressure on the US Federal Reserve and rising trade risks.

President Donald Trump's sharp criticism of Fed Chairman Jerome Powell has been in the spotlight. Sources say the White House has seriously discussed Powell's resignation, raising questions about the US central bank's independence and sending shockwaves through global markets.

A Weekend Without a Break for Markets

Despite the Easter holidays, which closed most European trading floors on Friday and Monday, a wave of instability swept global exchanges. Low liquidity only increased volatility.

S&P 500 futures fell by 0.75%, while the Nasdaq lost 0.8%. In Asia, Japan's Nikkei and Taiwan's TWII fell by more than 1%, while Chinese markets, despite the overall negative backdrop, managed to show modest growth.

Trade threats and political pressure hit the dollar

Trump continues to escalate tensions in financial markets with his statements and tariff policy. Investors are increasingly doubting the stability of the dollar and the attractiveness of American assets, traditionally considered a "safe haven" in turbulent times.

Markets reacted especially painfully to the new wave of rhetoric from the president, directed against the Fed and its leadership. The intensification of these attacks has become a catalyst for further loss of confidence.

Currency Swings: Dollar Loses, Gold, Franc Gain

Amid the risk-off trend, the dollar has weakened significantly. The euro has hit a three-year high, the Japanese yen has strengthened to a level not seen since September, and the Swiss franc has soared to a ten-year peak against the U.S. dollar.

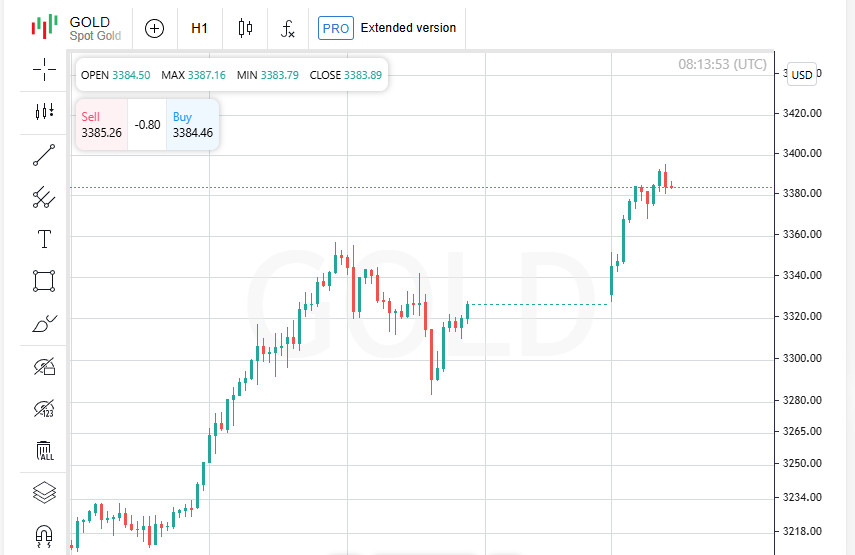

Meanwhile, gold, a classic safe haven in times of instability, has risen to record highs, a signal that investors are seeking shelter from the storm raging on the financial horizon.

Is the Fed's Independence in Danger? Experts Sound the Alarm

Chicago Federal Reserve President Austan Goolsbee expressed concern about mounting political pressure on the central bank in an interview on Sunday. He stressed that it is critical to preserve the Fed's ability to set monetary policy without outside interference. According to Goolsbee, the Fed's reputation as the world's leading central bank is based on its independence — and any attempts to undermine that could have long-term consequences for economic stability and investor confidence.

Markets react to nervousness: yields jump

Amid worrying signs from the political front, bond markets are showing mixed dynamics. The yield on 10-year U.S. Treasury notes rose by 3.5 basis points in Asian trading. At the same time, the two-year notes, which are more sensitive to rate changes, fell by 3.6 basis points.

This reflects growing market expectations for a possible rate cut — especially after Trump put pressure on the Fed's leadership.

Eyes on the giants: reporting season begins

This week, Wall Street's attention is focused on the publication of financial results from tech giants. Among them are holding company Alphabet, semiconductor giant Intel and electric car maker Tesla.

2025 has been a tough year for the so-called "magnificent seven" stocks, with Alphabet down around 20% and Tesla losing almost 40% of its market cap. Investors will be watching quarterly reports closely to see if there is a chance of a reversal.

Trading games continue: uncertainty weighs on businesses

Companies continue to adapt to the changing structure of US tariff policy. Despite temporarily suspending some high tariffs, the White House is maintaining a tough line and increasing pressure in international trade talks.

Relations with China, the world's second-largest economy, remain particularly tense. New rounds of negotiations are going hard, and the prospects for a sustainable agreement remain unclear. The business community is watching developments with concern, as further escalation could lead to new chains of disruptions and market volatility.

South Korea sees warning sign as exports plummet

The latest economic data from South Korea showed a sharp decline in exports in early April, a worrying sign that U.S. tariffs are starting to hit global trade more deeply.

Seoul and Washington are preparing for a new round of talks this week, but market participants are under no illusions: uncertainty is high and disagreements on key issues remain.

Private Conversations and Public Irritation: China and the U.S. Are Again on the Brink

President Trump said Friday that the U.S. and China are continuing to have "good private discussions" despite ongoing trade tensions. But Beijing's diplomacy has been far more measured, with its ambassador to the U.S. making it clear that there will be no constructive dialogue until Washington shows "the right level of respect."

The rhetorical divergence underscores that differences remain deep and the potential for escalation remains high.

Safe Haven Glitter: Gold Rewrites History Again

Gold continues its steady climb. On Monday, the precious metal surpassed $3,370 an ounce, setting a new all-time high. A gain of more than 1% in a day brought gold's year-to-date return to an impressive 26%.

Amid growing geopolitical instability and currency market volatility, investors are increasingly seeking safe havens, and gold, as always, lives up to its status as an "evergreen."

Oil Loses as Iran and the US Draw Closer

Oil prices fell after news of progress in nuclear talks between Tehran and Washington. The prospect of a partial normalization of relations eased fears of supply disruptions from one of the key producers in the Middle East. Brent crude futures fell 1.75% to $66.77 per barrel, while American WTI also fell by the same 1.75%, reaching $63.55. This is a reminder to the market of how quickly geopolitics can change the direction of price movements.

Cryptocurrency on the rise: Bitcoin renews peaks

Amid the general instability in traditional markets, investors do not forget about digital assets. Bitcoin confidently went up on Monday, adding almost 3% and reaching $87,515 — the highest since the beginning of the month.

The cryptocurrency market remains a volatile alternative for those looking for both protection from inflation and opportunities for speculative growth.

South Korea on the brink of recognition: the market may receive the status of developed

Seoul is making confident steps towards revising its investment image: on Monday, a representative of the South Korean financial regulator said that the probability of including the national stock market in the list of developed markets is extremely high.

This step could open up new horizons for international investors and strengthen the country's position as a key player in the global financial architecture.

Despite the fact that South Korea is the fourth-largest economy in Asia with a highly developed infrastructure, technological superiority and a stable macroeconomics, it is still listed as an emerging market in the MSCI classification.

This discrepancy has long raised questions among both analysts and international players who see in South Korean assets the stability and maturity typical of developed jurisdictions.

Unblocking "shorts": a step towards investors

One of the key barriers to updating the status has long been the ban on short selling. But last month, the country completely lifted the restriction across its entire stock market for the first time in five years, removing one of the main obstacles that both MSCI and major foreign investors had pointed out.

The move was seen as a signal of commitment to transparency, competitiveness, and openness – key criteria for inclusion in the developed market category.

A Crucial Month: MSCI Prepares Classification Update

All eyes now turn to Morgan Stanley Capital International's June index review. Under MSCI's standard process, markets typically go through a one- to two-year observation period before a full reclassification.

If South Korea makes the shortlist, it would be a major step toward future recognition – with the potential for hundreds of billions of dollars of passive investment automatically tracking the MSCI indices.