US markets in turmoil: Nvidia hit, Fed warns

Wednesday's biggest stock decline came as the US-China tech standoff intensified and the Federal Reserve chief issued a cautious outlook.

US stock markets took a major hit after Nvidia, one of the world's leading chip makers, said it could lose billions of dollars due to tighter export rules. Investors were further pressured by comments from Federal Reserve Chairman Jerome Powell, who pointed to signs of a slowdown in the US economy.

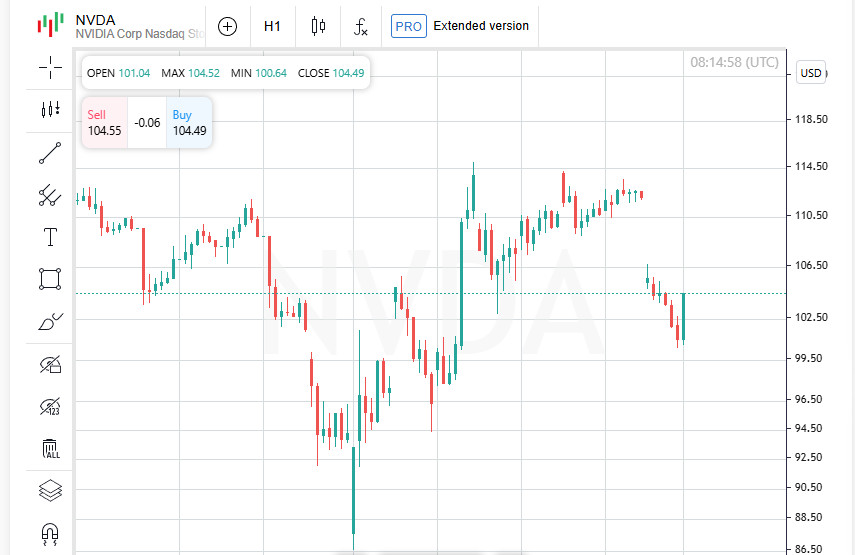

Nvidia Caught Under Sanctions Roller

Late on Tuesday, Nvidia said it could suffer losses of $5.5 billion. The reason is a new restriction by US authorities on the export of its key H20 chip, focused on artificial intelligence, to China. This country is one of the main consumers of Nvidia's high-tech products, and the ban hit right at the heart of one of the company's most profitable areas.

Trade War Enters a New Spire

This move by the US was a continuation of the escalation of the economic conflict between the two world powers. Earlier, in response to Washington's actions, Beijing increased tariffs on American goods to 125%. This followed the decision by then-President Donald Trump to raise tariffs on Chinese imports to 145%, effectively escalating protectionist rhetoric.

Powell: Inflation is not giving up, and growth is slowing

Speaking at the Economic Club of Chicago, Powell noted that the current economic realities do not allow for relaxation. He noted that tariff policy contributes to price growth, which means that inflationary pressure may persist longer than expected. However, the head of the Fed stressed that the Central Bank will not rush to adjust interest rates - the decision will be made only on the basis of new macroeconomic data.

Panic on the stock exchange: the sell-off is accelerating

Powell's statements were made against the backdrop of an already started sell-off caused by alarming news from Nvidia. As a result, US stock indices showed a sharp decline on Wednesday, with shares of tech giants and microchip makers suffering especially, as investors began to quickly dump them.

Wall Street under attack: All three key indices fall

US stock markets experienced one of the most dramatic days since the beginning of the year on Wednesday, with three leading indices going into deep negative territory.

The Dow Jones index fell by 699 points, ending the session at 39,669.39, a decline of 1.73%. The S&P 500 index fell even more, losing 120.93 points (minus 2.24%), falling to 5,275.70. But the hardest hit was the high-tech Nasdaq Composite, which fell by 516 points, or 3.07%, to 16,307.16. The intraday bottom was even lower, at 16,066.46.

Volatility Sounds the Alarm: Fear Index Rising

As investors rush to withdraw capital from risky assets, the Cboe VIX volatility index, an unofficial barometer of Wall Street anxiety, jumped sharply.

The VIX closed at 32.64 on Wednesday, signaling serious nervousness among market participants. Such index values traditionally indicate growing uncertainty and the likelihood of further volatility.

Nvidia and AMD Under Double Blow

The tech sector was at the epicenter of the collapse. Semiconductor manufacturers, victims of new export restrictions, were hit especially hard.

Nvidia shares fell 6.9% on the day, continuing their decline caused by news of sanctions. AMD followed suit, falling 7.3%. As a result, the SOX industry index, which unites semiconductor companies, fell 4.1%, which was one of its largest declines in recent months.

ASML signals worrying trends

The uncertainty has spread beyond the U.S. Europe's largest chip-equipment maker, Dutch company ASML, has expressed concern about the situation.

In a statement on Wednesday, ASML warned that tariffs and restrictions were creating significant uncertainty about future demand and supply chain stability. This has added to the nervousness not only in U.S. markets but also in European markets.

Europe watches with bated breath

While the US is experiencing another round of market turbulence, investors on European markets are remaining reserved.

The STOXX 600 index, which reflects the dynamics of the region's largest companies, fell by 0.4% at the start of trading on Thursday. Despite this, since the beginning of the week, the index has shown growth of almost 4% - the absence of new aggravations in the trade conflict has temporarily stabilized the situation. However, investors are in a wait-and-see mode, closely monitoring the upcoming decision of the European Central Bank on monetary policy.

The calm before the storm: markets are holding their breath amid the long weekend

Investors decided not to take risks and postponed large transactions for later - there is a long holiday weekend ahead, associated with Good Friday and Easter Monday.

The lack of activity in trading is explained not only by the religious calendar, but also by the increased instability in the global economy. Market participants tried to limit exposure before four days of holidays, when global events can unfold without their participation, and there will be no one to react to them.

Luxury has lost ground: Hermes and LVMH did not live up to expectations

Even the luxury segment of the market failed: Hermes shares fell by 4% after an unexpected decline in quarterly sales. This is a rare event for the maker of the legendary Birkin bags.

The French fashion house followed in the footsteps of rival LVMH, which earlier in the week also disappointed investors with sluggish earnings dynamics. It seems that even luxury is losing its shine amid instability in global consumer demand.

Energy surprise from Siemens

In contrast to the luxury sector, Siemens Energy brought unexpected joy to investors, whose shares soared by 10%.

The German energy holding company published improved forecasts for the current financial year and reported the best profitability since leaving the wing of Siemens AG. This was good news for the German stock market as a whole, with the benchmark DAX index outperforming its European peers thanks to the energy rally.

Asia at a crossroads: mixed trading, but the positive sentiment remains

In Asia, stock indices moved in different directions, but the overall mood remained moderately optimistic.

Japan's Nikkei gained 0.7%, while the national currency, the yen, lost ground as Japan began trade talks with the United States. An unexpected factor was the personal involvement of Donald Trump, who declared "significant progress" at a meeting with Japanese representative Resei Akazawa.

A complex mosaic: Asia amid the American collapse

The roller coaster continues to influence the mood of global markets. Despite this, Asian markets remain in the game.

South Korea managed to show growth, with the KOSPI index strengthening by 0.7%. At the same time, Taiwan did not support the positive trend - the local TWII index fell by 0.5%. Such disunity suggests that investors are still looking for support, maneuvering between geopolitics and domestic economic data.

Europe on pause: futures hint at a cautious opening

Expectations ahead of the opening of European trading are restrained. Futures point to a neutral or slightly positive start to the session.

Apparently, the markets of the Old World will move carefully, understanding the results of corporate reports, signals from the ECB and the consequences of the trade policy that the eccentric US president continues to pursue. And although no surges are expected, the background is still tense.

Eyes on the Taiwanese giant: the market awaits the TSMC report

Investors' focus has shifted to one of the key players in the global semiconductor industry - Taiwan Semiconductor Manufacturing Co.. It is its profit forecast that can set the tone for the entire microchip market. Amid geopolitical tensions and a new wave of technology restrictions, TSMC's earnings report is expected to provide answers on how resilient the industry is and whether it has room to grow in the coming quarters.

Cautious optimism in China and a surge in Hong Kong

Trading was muted in mainland China, with the CSI300 index tracking the largest companies remaining virtually unchanged. However, the Hang Seng in Hong Kong showed solid growth, up 1.6%.

The growth was driven by technology companies, whose shares rebounded after a recent wave of selling. Market participants are betting on a recovery in interest in the high-tech sector despite global challenges.

Bonds are calm, yields are rising

The US government debt market remained surprisingly stable throughout the week. The yield on 10-year US Treasury bonds only slightly increased by 3 basis points, reaching 4.311%.

This indicates a reserved mood among investors: they prefer to observe the development of macroeconomic signals, without rushing to exit "defensive" assets.

Currency swings: euro loses, dollar strengthens, yen loses ground

The euro fell 0.3% to $1.1367, although it remains close to a three-year peak reached last week. The ECB decision is on the agenda, and markets are almost certain of a rate cut soon.

The dollar index, which measures the strength of the American currency against six major ones, rose slightly to 99.562.

The yen, however, showed sharp dynamics: having reached a seven-month high during the session, later weakened by 0.55%, falling back to 142.64 per dollar. The reason was a statement by Japanese Economy Minister Resei Akazawa that currency issues were not raised during his talks with the United States.

Gold is back at its zenith: investors are fleeing to a "safe haven"

Gold prices have updated their historical maximum, jumping to $3,357.40 per ounce at the height of trading. Later, the metal corrected to $3,341.91, but remained at an extremely high level.

Demand for gold remains stable amid growing geopolitical risks and unclear prospects for interest rates. Investors are seeking refuge in proven assets, and the yellow metal is still one of the main candidates.

Black gold under pressure from deficit: oil continues to rise in price

Oil prices have gone up - fears about a reduction in supply are pushing quotes to new heights.

Brent futures added 0.93%, settling at $66.46 per barrel. American WTI also showed growth - by more than 1%, reaching $63.20 per barrel. Market participants expect supply disruptions and rising geopolitical tensions to support energy demand in the short term.