The GBP/USD currency pair failed to consolidate above the moving average on Thursday, so the correction continues for now.

Throughout Thursday, the GBP/USD pair was unable to hold above the moving average line, so the correction remains in progress. In the second half of the day, the U.S. dollar began to rise sharply without any clear explanation. No major reports were released this week, and the only recurring theme has been tariffs, tariffs, and more tariffs. As of July 10, Trump hasn't actually imposed any new tariffs, though he has promised to raise them for 22 countries starting August 1. From the same date, copper, pharmaceuticals, and several other product categories will also become subject to trade duties.

But all this is set to happen on August 1—and Trump's stance could change 100 times before then. That's why the market is in no hurry to react to these announcements. Corrections, after all, are a normal occurrence. In the EUR/USD article, we discussed why Trump himself has little incentive or desire to implement new measures against countries reluctant to sign the trade deals the U.S. demands. There's no one to "rescue" the U.S. economy. Yes, the Fed may eventually lower interest rates—two rounds of easing are planned for 2025—but this isn't exactly what Trump wants, nor is it enough to shield the U.S. economy from the impact of widespread tariffs.

Trump believes the key interest rate should be 3% lower than the current level of 4.5%. The Fed plans to lower it by just 1% over the next 2.5 years. In effect, the Fed has tied Trump's hands, forcing him to be more conciliatory in trade negotiations and to offer repeated delays. He is now forced to balance his relentless desire to issue threats with the futility of pushing back against the Fed. It is precisely the Fed's reluctance to cut rates that explains Trump's repeated "grace periods," "amnesties," and extensions to tariff implementation deadlines.

As for U.S. inflation, it continues to rise slowly and modestly. It seems Trump's tariffs are having little impact on consumer price growth. However, it's important to consider that prices in the U.S. are set by companies—most of which prepared for the trade war by stockpiling goods, raw materials, and supplies. These inventories are still sufficient to avoid making new purchases abroad at higher prices. But eventually, these reserves will run out—and when they do, prices are likely to rise much more sharply.

This also suggests that the U.S. economy has yet to fully react to the trade war. If prices are barely rising, then consumer demand hasn't dropped, and household incomes haven't lost value. Once inventories are depleted, we may see a completely different picture. Moreover, tariffs are set to increase again after each 3-month grace period. Trump continues to single out new U.S. industries allegedly "destroyed" by the Biden administration—industries now supposedly in need of presidential protection. So how can we expect the U.S. economy to accelerate under increasingly extensive and burdensome trade restrictions?

In conclusion, the dollar's current rally doesn't align with any recent news or fundamental developments. Last week offered more justification for a dollar rebound than this one, where no key reports were published, and the only updates have been fresh tariff announcements. If trade war escalation used to pressure the dollar, why would it now support its strength? Let's not forget—Trump has still only signed two trade deals.

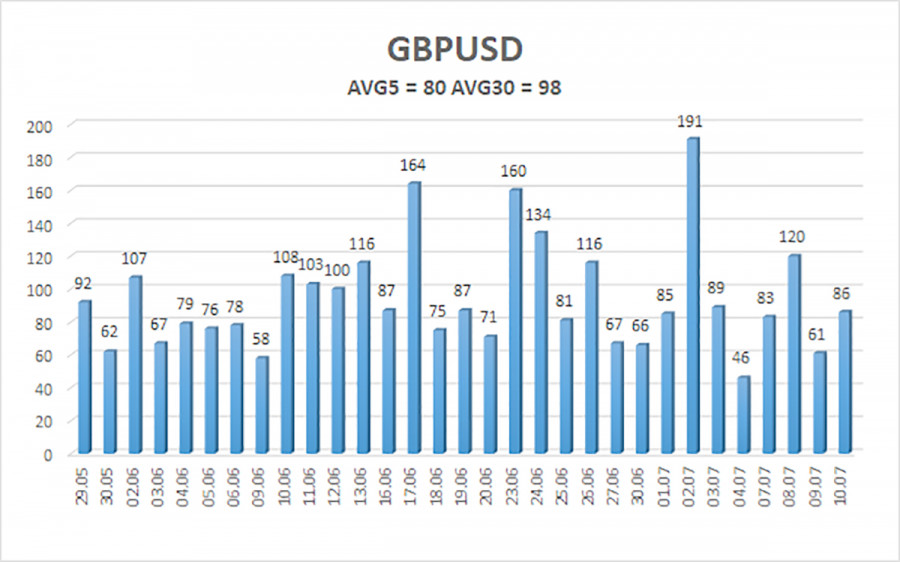

The average volatility of the GBP/USD pair over the past 5 trading days is 80 points. For this pair, this is considered "average." Therefore, on Friday, July 11, we expect movement within the range of 1.3493 to 1.3653. The senior linear regression channel remains upward-sloping, confirming the prevailing uptrend. The CCI indicator has entered the oversold zone for the second time recently, again signaling a potential upward reversal. A bullish divergence has also formed.

Nearest support levels:

- S1 – 1.3550

- S2 – 1.3489

- S3 – 1.3428

Nearest resistance levels:

- R1 – 1.3611

- R2 – 1.3672

- R3 – 1.3733

Trading Recommendations:

The GBP/USD pair continues to correct downward, but this may soon come to an end. In the medium term, Donald Trump's policies will likely continue to weigh on the dollar. As such, long positions remain relevant above the moving average, with targets at 1.3672 and 1.3733 in line with the prevailing trend. If the price stays below the moving average, small short positions may be considered with targets at 1.3550 and 1.3493. However, we still do not expect a strong dollar rally. The U.S. currency may occasionally rebound, but any sustained strength would require clear signs of a resolution to the global trade war.

Illustration Explanations:

- Linear regression channels help identify the current trend. When both point in the same direction, the trend is considered strong.

- The moving average line (settings 20,0, smoothed) indicates the short-term trend and trading direction.

- Murray levels mark target points for trend continuation or corrections.

- Volatility levels (red lines) outline the expected price channel for the next 24 hours based on current volatility.

- The CCI indicator entering the oversold (below -250) or overbought (above +250) zones signals an upcoming trend reversal.