Analysis of Trades and Trading Tips for the Euro

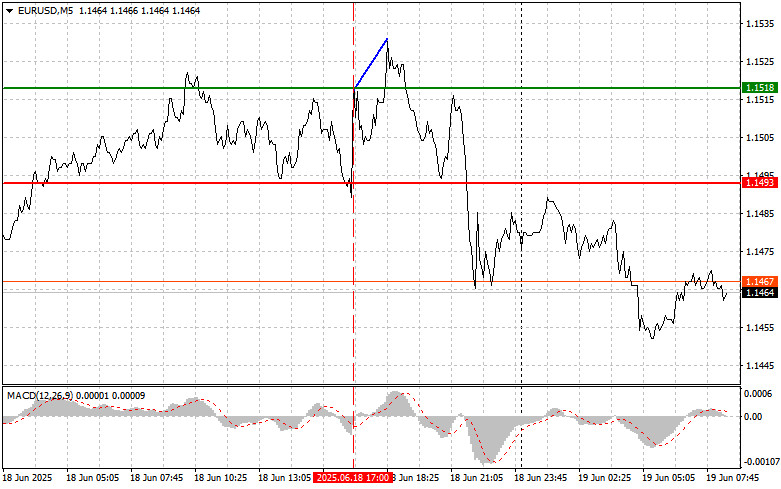

The price test at 1.1518 occurred when the MACD indicator started to move upward from the zero mark, confirming the correct entry point for buying the euro—which resulted in only a 10-pip increase.

Following yesterday's unanimous decision by the Federal Open Market Committee (FOMC) to maintain the federal funds rate within the range of 4.25%–4.5%, the U.S. dollar strengthened. While this decision was not unexpected, it reinforced market participants' confidence in the Federal Reserve's predictable approach. In its accompanying statement, the FOMC emphasized that inflation is declining and moving toward acceptable levels but that reaching the 2% target still requires maintaining the current policy path. At the same time, the Committee acknowledged slowing economic growth and weakening labor market conditions, recognizing the potential for a recession in the future. Keeping the rate unchanged allows the Fed to monitor economic developments closely. Despite ongoing investor concerns over growth prospects, they appear to be reassured by the Fed's cautious and measured stance. Inflation and employment data will be critical in determining the central bank's next steps in the coming months.

Today, the eurozone economic calendar lacks significant fundamental data. The market will focus on Bundesbank President Joachim Nagel's speech and the Eurogroup meeting. Nagel will likely address the current state of the German and eurozone economies, emphasizing assessing inflation risks and growth outlooks. At the Eurogroup meeting, finance ministers from eurozone countries will discuss current economic challenges and coordinate fiscal policy, with key topics expected to include inflation, energy security, and economic support amid geopolitical tensions.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

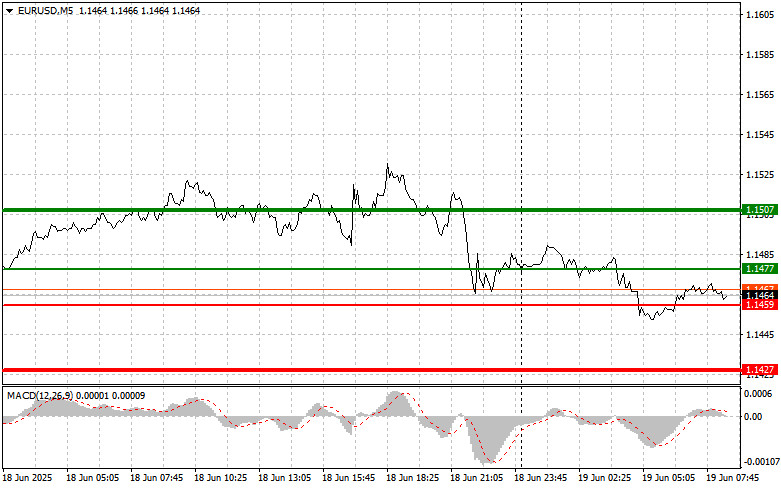

Scenario #1: Buy the euro when the price reaches 1.1477 (green line on the chart), targeting a rise toward 1.1507. I plan to exit the market at 1.1507 and initiate a short position in the opposite direction, anticipating a 30–35 pip retracement. Euro strength today is likely to be corrective only.

Important: Before buying, ensure the MACD is above the zero line and starting to rise from it.

Scenario #2: I also plan to buy the euro if there are two consecutive tests of the 1.1459 level while the MACD is in oversold territory. This will limit the pair's downside potential and trigger an upward reversal—expected upside targets: 1.1477 and 1.1507.

Sell Scenario

Scenario #1: I plan to sell the euro after it reaches 1.1459 (red line on the chart), aiming for 1.1427 as the target level, where I'll exit the market and enter a buy trade expecting a 20–25 pip reversal from that level. Downward pressure on the pair may return at any moment.

Important: Before selling, ensure the MACD is below the zero line and starting to decline.

Scenario #2: I also plan to sell the euro in case of two consecutive tests of 1.1477 while the MACD is in overbought territory.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.