The EUR/USD currency pair continued to trade very calmly throughout Wednesday. The market showed no reaction whatsoever to the seemingly positive news regarding U.S.-China trade negotiations. Why? Because that positivity was only on paper. Yes, Washington and Beijing agreed to ease certain tariffs in exchange for some specific concessions. For instance, China promised to accelerate the export of various rare earth metals to the U.S., and the U.S., in return, agreed to reduce tariffs on some categories of goods. However, no details were provided about which goods these are or what their trade volumes amount to. Thus, the ongoing trade war between the U.S. and China remains unchanged. If the pace of tariff and restriction reductions continues, negotiations may last another 10 years.

From our viewpoint, the most significant indicator was how the market reacted. Traders saw nothing encouraging in the news that China and the U.S. had agreed to continue negotiations or "reduce some tariffs on some goods." Over the past four months alone, the White House has issued a flood of statements claiming everything will be fine. Yet the economic situation continues to deteriorate, protests against Donald Trump are sweeping across the U.S., and the country has alienated numerous trade partners. Despite this, the U.S. President promises beneficial trade deals that will supposedly improve the trade balance, reduce the budget deficit and national debt, and create new jobs for Americans.

Meanwhile, many economists argue that Trump's new legislative proposals will actually increase the national debt by another $3 trillion. Large American companies are not planning to return to the U.S. While taxes for some groups of Americans will be reduced, overall, Americans will pay more for the same goods. In short, we continue to see no real positive developments for the U.S. dollar.

A few weeks ago, we suggested that de-escalation and eventual resolution of the trade war could allow the dollar to regain its former levels from four months ago. Today, we strongly doubt that scenario. Although Trump's policies are a significant factor in the market's decline of the U.S. dollar, it is clear that his policy has become the key driver of the market, and we must accept that.

Moreover, while the U.S. and Chinese delegations may have agreed on terms in London, these diplomatic advances still require approval from the leaders of both countries. Given Trump's track record, he could easily reject the agreement and unleash another barrage of criticism on China. Meanwhile, China remains in no hurry to concede to Washington. Although Chinese exports to the U.S. may have declined, exports to other countries have increased, making little difference to Chinese manufacturers where their products go.

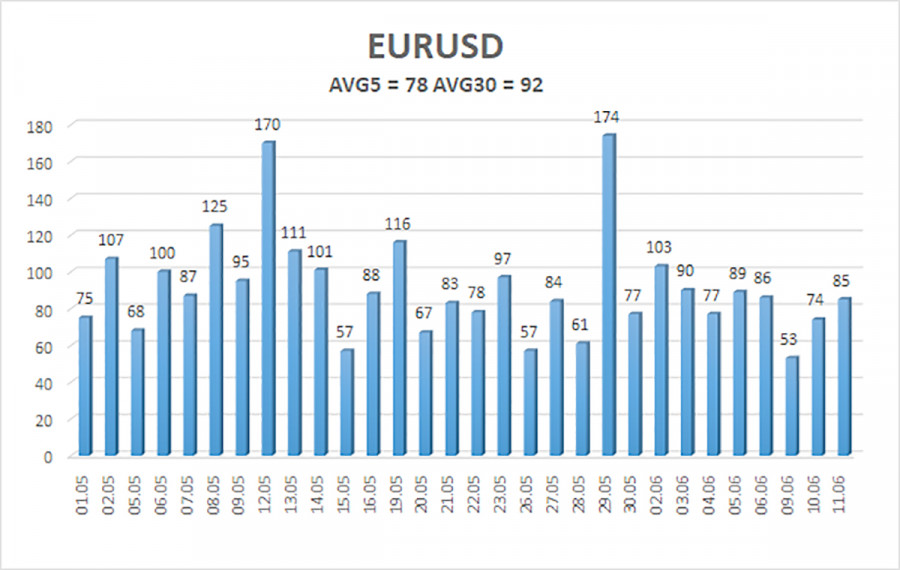

The average volatility of the EUR/USD pair over the last five trading days (as of June 12) is 78 pips, which is classified as "moderate." We expect the pair to move between 1.1407 and 1.1563 on Thursday. The long-term regression channel remains upward, confirming the ongoing uptrend. The CCI indicator entered the oversold zone and formed a bullish divergence, which triggered the resumption of the upward trend.

Nearest Support Levels:

S1 – 1.1475

S2 – 1.1414

S3 – 1.1353

Nearest Resistance Levels:

R1 – 1.1536

R2 – 1.1597

Trading Recommendations:

The EUR/USD pair remains in a bullish trend. Trump's foreign and domestic policies continue to exert substantial downward pressure on the U.S. dollar. Furthermore, the market frequently interprets incoming data in a way that disadvantages the dollar. There is a clear reluctance to buy the dollar, even when justifications exist.

Below the moving average, short positions remain relevant, with targets at 1.1353 and 1.1292, though a major drop is unlikely in the current environment. Above the moving average, long positions targeting 1.1536 and 1.1563 remain in line with the prevailing trend.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.