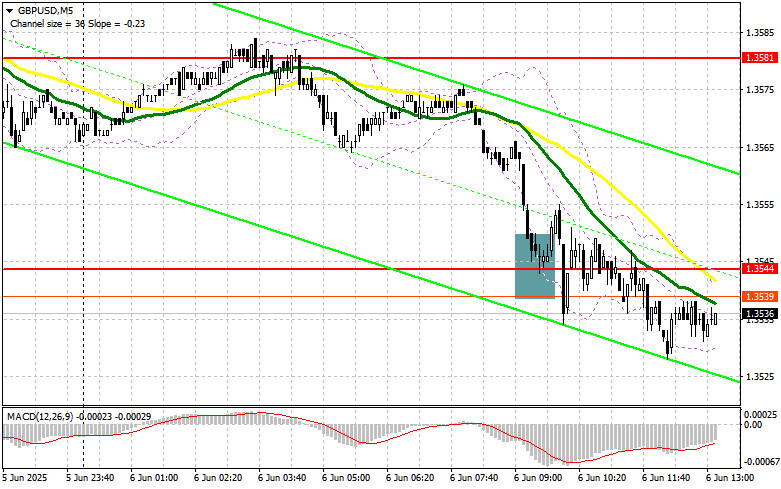

In my morning forecast, I highlighted the 1.3544 level and planned to make market entry decisions based on it. Let's look at the 5-minute chart and see what happened. A decline toward 1.3544 occurred, followed by a false breakout, providing a buying opportunity for the pound, but no significant growth materialized. The technical picture was not revised for the second half of the day.

Requirements for Opening Long Positions on GBP/USD:

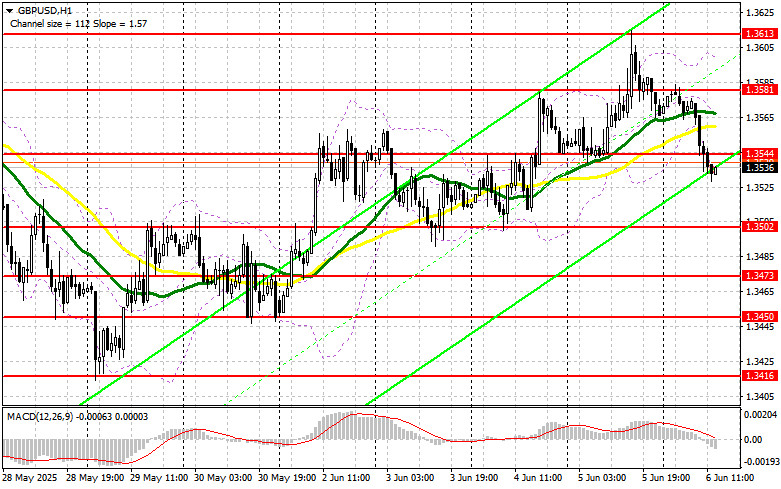

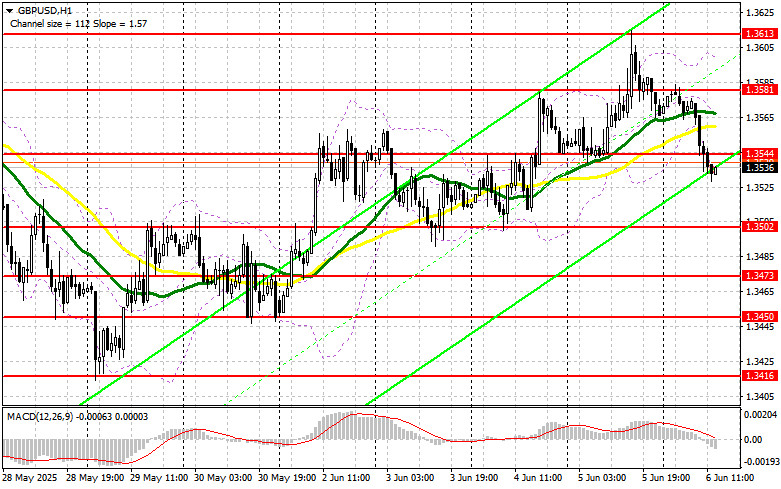

Now everything depends on the U.S. labor market data. Strong nonfarm payroll growth above economists' forecasts would be a reason to continue selling the pound and buying the dollar. Otherwise, the pair may see a strong upward movement. In case of strong data, I prefer to act around the 1.3544 support, where trading is currently taking place. A false breakout there, similar to the earlier scenario, would be a good signal to buy GBP/USD, aiming for a return to the 1.3581 resistance. A breakout and retest of this range from above would create a new entry point for long positions, extending the bullish market with a target of 1.3613. The ultimate target would be the 1.3659 area, where I would take profit.

If GBP/USD declines and bulls show no activity around 1.3544, pressure on the pound could significantly increase. In that case, only a false breakout around 1.3502 would provide a suitable condition for opening long positions. Alternatively, I plan to buy GBP/USD on a rebound from the 1.3473 support, targeting an intraday correction of 30–35 points.

Requirements for Opening Short Positions on GBP/USD:

Sellers made an attempt, but the market remains on the buyers' side, and only very strong U.S. labor market data — which is unlikely — could limit the pair's upward potential. If GBP/USD spikes upward after the data release, I plan to act after a false breakout around the 1.3581 resistance. This would be sufficient for an entry point to sell, targeting a decline to the 1.3544 support. A breakout and retest from below would trigger stop-loss orders and open the path to 1.3502. The ultimate target would be the 1.3473 area, where I plan to take profit.

If demand for the pound persists in the second half of the day and bears do not show up at 1.3581, it's better to postpone selling until the 1.3613 resistance is tested. I will open short positions there only after a failed breakout. If there's no downward movement even there, I'll look for short opportunities around 1.3659, but only for an intraday correction of 30–35 points.

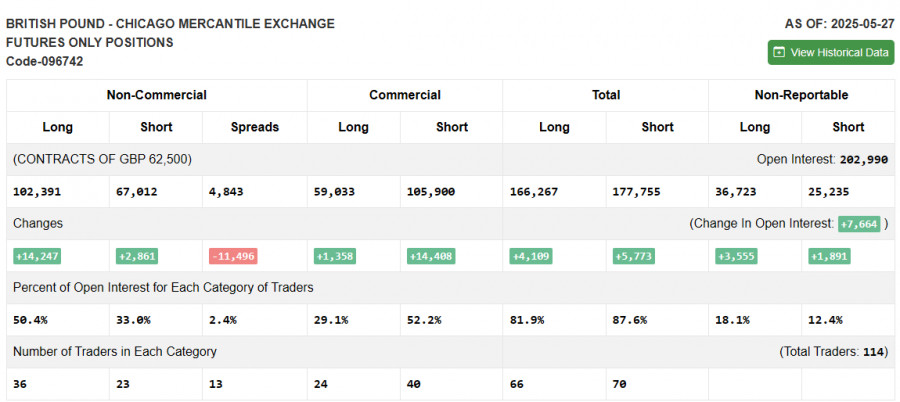

The COT (Commitment of Traders) report dated May 27 showed a sharp increase in long positions and a less active increase in short positions. Following the trade agreement between the U.K. and the U.S., demand for the pound continues to persist. Considering the Bank of England remains on the sidelines and refrains from monetary intervention, there are fairly good chances for further strengthening of the pound. Add to that the ongoing trade disputes between China and the U.S. and the weakness of the U.S. dollar, and it becomes clear that the medium-term bullish trend for the pound is not yet over. No significant U.K. statistics are expected soon, so there are fewer reasons for large players to sell the pound than to buy it. The latest COT report indicates that long non-commercial positions rose by 14,247 to 102,391, while short non-commercial positions rose by 2,861 to 67,012. As a result, the gap between long and short positions narrowed by 11,469.

Indicator Signals:

Moving Averages

Trading is occurring below the 30- and 50-period moving averages, indicating a potential decline in the pair.

Note: The period and prices of the moving averages considered are on the H1 hourly chart and differ from the classic daily moving averages on the D1 chart.

Bollinger Bands

In case of a decline, the lower boundary around 1.3544 will act as support.

Indicator Descriptions:

- Moving Average (determines the current trend by smoothing volatility and noise), Period – 50, marked in yellow on the chart;

- Moving Average, Period – 30, marked in green on the chart;

- MACD Indicator (Moving Average Convergence/Divergence) – Fast EMA: 12-period, Slow EMA: 26-period, SMA: 9-period;

- Bollinger Bands, Period – 20;

- Non-commercial traders – Speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain requirements;

- Long non-commercial positions represent the total long open positions of non-commercial traders;

- Short non-commercial positions represent the total short open positions of non-commercial traders;

- Net non-commercial position is the difference between the short and long positions of non-commercial traders.