Analysis of Trades and Trading Tips for the Euro

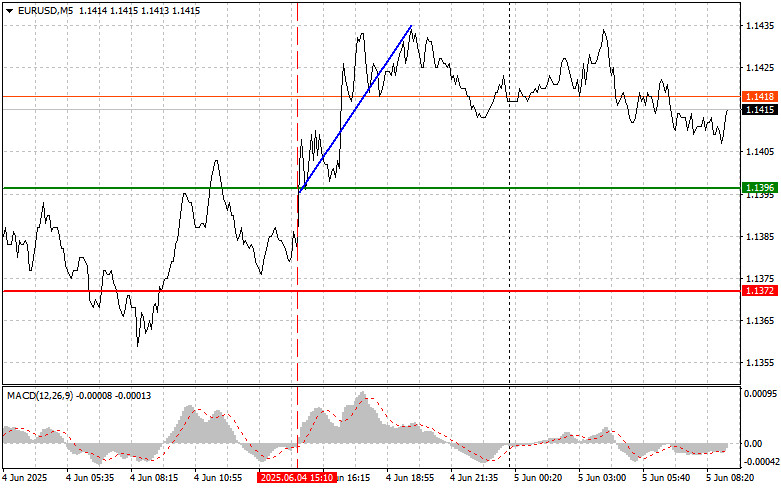

The test of the 1.1396 price level coincided with the moment when the MACD indicator had just started moving upward from the zero line. This confirmed a correct entry point for buying the euro, resulting in a rise of more than 40 pips.

Disappointing employment data from ADP and a decline in ISM services sector activity triggered a sharp drop in the dollar while simultaneously strengthening the euro. Fearing an impending US economic recession, investors actively sold off dollar assets. The labor market data was deeply disappointing. A private sector employment growth of 111,000 was expected, but only 33,000 jobs were added. In this context, market participants widely believed the Federal Reserve could lower interest rates sooner than previously indicated. However, the decisive factor will be tomorrow's reports on the US unemployment rate and nonfarm payrolls. The complex geopolitical situation also impacts currency exchange rates and the US dollar.

Today, we await data on changes in German manufacturing orders and the Eurozone producer price index. The key event will be the European Central Bank's announcement on the key interest rate, followed by a press conference with Christine Lagarde. In anticipation of this event, markets are uncertain, trying to predict the steps the ECB will take to stimulate the economy. There will be a special focus on Christine Lagarde's remarks. Investors eagerly await clear guidance on the future course of the ECB's monetary policy.

Today promises to be eventful and characterized by heightened volatility. Traders are advised to remain vigilant and closely monitor incoming information.

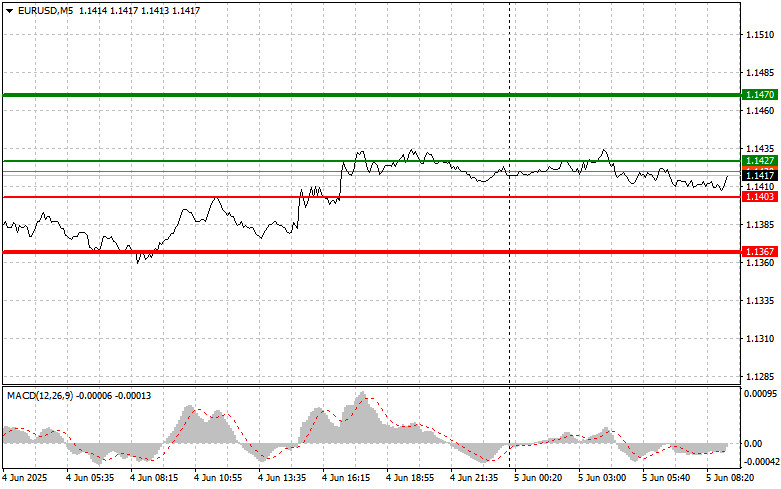

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

Scenario #1: Today, I plan to buy the euro if the price reaches around 1.1427 (green line on the chart), aiming for growth toward 1.1470. At 1.1470, I plan to exit the market and open a sell position in the opposite direction, expecting a 30–35 pips movement from the entry point. Expect euro growth only after strong data releases.

Important! Before buying, ensure the MACD indicator is above the zero line and just starting its upward move.

Scenario #2: I also plan to buy the euro today in case of two consecutive tests of the 1.1403 price level when the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to an upward reversal. Expect a rise toward the opposite levels of 1.1427 and 1.1470.

Sell Scenario

Scenario #1: I plan to sell the euro after reaching the 1.1403 level (red line on the chart). The target will be 1.1367, where I plan to exit the market and immediately open a buy position in the opposite direction, expecting a movement of 20–25 pips in the opposite direction. Selling pressure will return to the pair in case of hints at further ECB rate cuts.

Important! Before selling, make sure the MACD indicator is below the zero line and just starting its downward move.

Scenario #2: I also plan to sell the euro today in case of two consecutive tests of the 1.1427 price level when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a downward reversal. Expect a decline toward the opposite levels of 1.1403 and 1.1367.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.