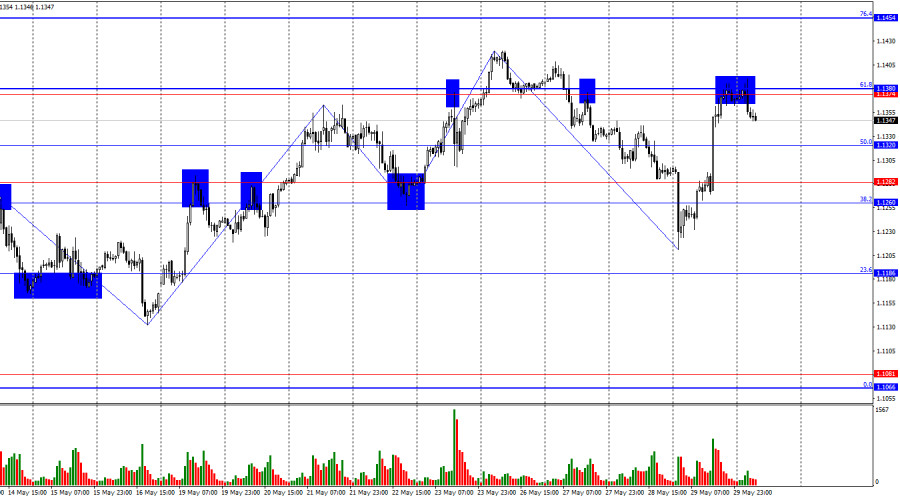

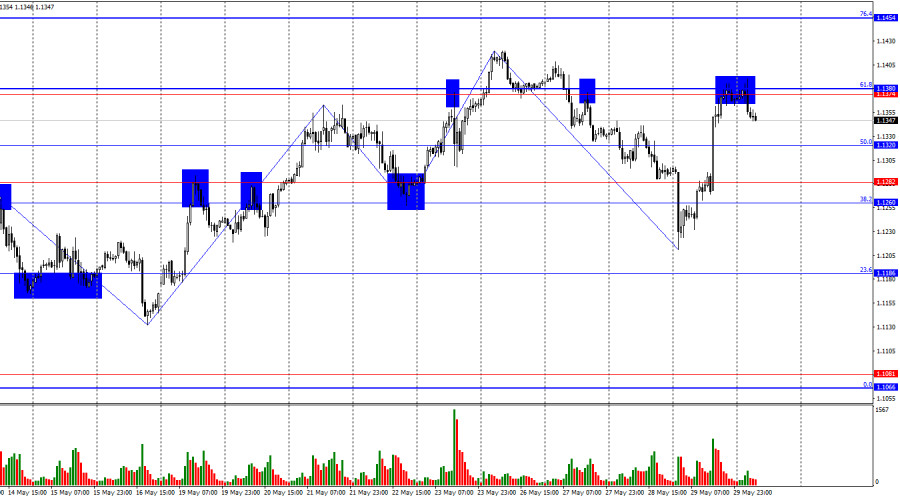

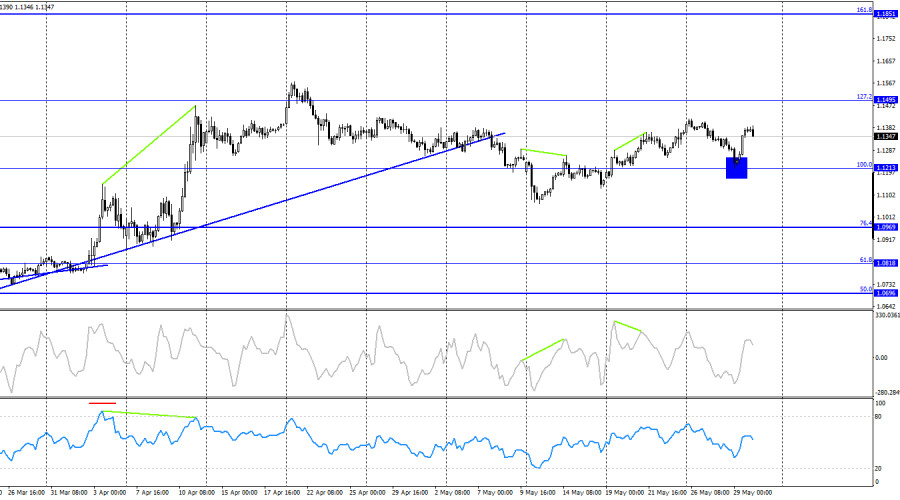

On Thursday, the EUR/USD pair sharply reversed in favor of the euro and rose into the resistance zone of 1.1374–1.1380. A rebound from this zone favored the U.S. dollar and the potential resumption of a decline towards the 50.0% Fibonacci level at 1.1320 and the support zone of 1.1260–1.1282. Yesterday, the waves signaled the end of the bullish trend. A strong corrective pullback combined with a good sell signal suggests a new decline for the pair. A consolidation above the 1.1374–1.1380 level would allow for further growth toward the 76.4% Fibonacci retracement at 1.1454.

The wave situation on the hourly chart has changed. The last completed upward wave broke the previous high, but the last downward wave broke the previous low. Thus, the trend may now be shifting to a bearish one. Recent news regarding the cancellation of tariff hikes for the European Union and mutual tariff reductions between China and the U.S. supported the bears, but yesterday the Court first ruled to cancel all of Trump's tariffs and then postponed its decision by 14 days, allowing the bulls to launch a striking counterattack.

The news on Thursday was not expected to bring anything interesting, but overnight the U.S. Court of International Trade ruled that Trump had exceeded his presidential powers when he imposed global tariffs on imports from many countries. The Court satisfied the claim of 12 U.S. states, stating that only Congress has the authority to impose tariffs, or at least must approve them before they are enacted. Trump had declared a national emergency in trade due to the trade deficit. Under U.S. law, a national emergency allows the president to make decisions independently, but, as it turns out, not regarding tariffs. By the evening, the situation became almost comical: the Court reviewed Trump's immediate appeal and, citing national security, suspended its decision for 14 days. Thus, for the next two weeks, all tariffs will definitely remain in effect.

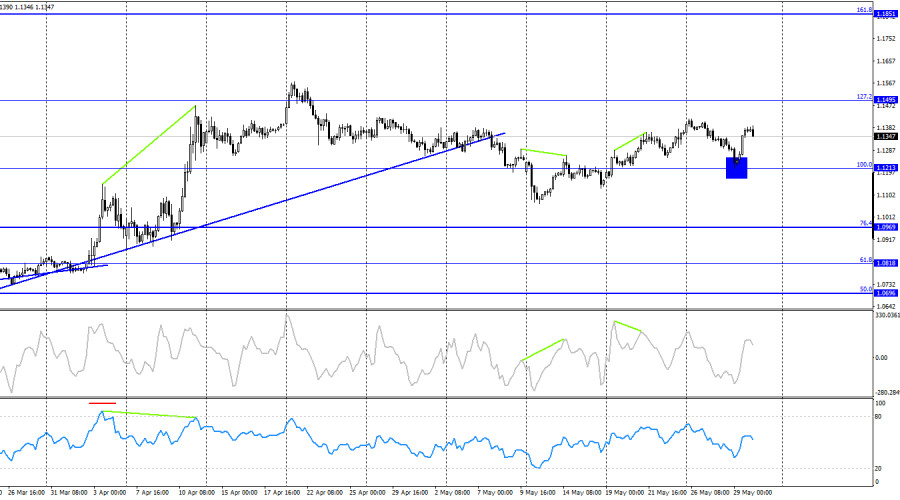

On the 4-hour chart, the pair returned to the 100.0% Fibonacci retracement at 1.1213 and rebounded from it. This rebound enabled a reversal in favor of the euro and the expectation of growth toward the 127.2% Fibonacci retracement at 1.1495. A consolidation below 1.1213 would signal a continuation of the decline toward the next Fibonacci level at 76.4%, or 1.0969. No looming divergences are observed on any indicator.

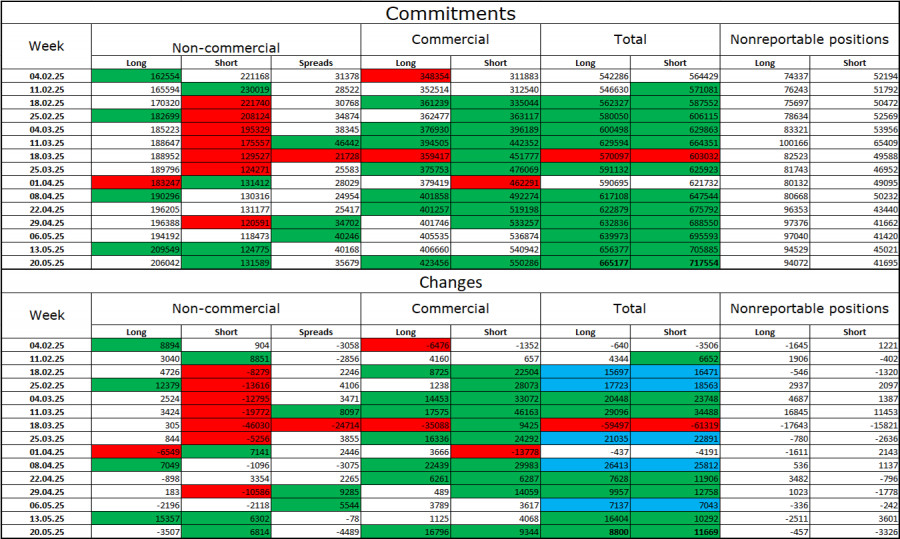

Commitments of Traders (COT) Report:

During the last reporting week, professional traders closed 3,507 long positions and opened 6,814 short positions. The sentiment of the "Non-commercial" group remains bullish — thanks to Donald Trump. The total number of long positions held by speculators now stands at 206,000, while short positions are at 132,000, and the gap between them (with rare exceptions) continues to widen. Thus, the euro remains in demand, while the dollar does not. The situation remains unchanged.

For sixteen consecutive weeks, large players have been reducing short positions and increasing longs. The divergence in monetary policy between the ECB and the Fed still works in favor of the dollar, but Donald Trump's policy is a more significant factor for traders, as it could lead to a recession in the U.S. economy and a host of other long-term structural problems.

Economic News Calendar for the U.S. and Eurozone:

- Eurozone – Retail Sales Change in Germany (06:00 UTC)

- Eurozone – Inflation Rate in Germany (12:00 UTC)

- U.S. – PCE Price Index (12:30 UTC)

- U.S. – Personal Income and Spending (12:30 UTC)

- U.S. – University of Michigan Consumer Sentiment Index (14:00 UTC)

On May 30, the economic event calendar includes five entries. The impact of the news background on market sentiment on Friday may be moderate, but most likely traders will focus more on the ongoing tariff saga rather than economic statistics. Thursday's events delivered significant news, and whether bullish or bearish, Friday's data will likely be secondary to the tariff developments.

EUR/USD Forecast and Trading Tips:

Sales were possible today on a bounce from the 1.1374–1.1380 zone with targets at 1.1320 and 1.1260–1.1282. Today, I recommend considering purchases on a bounce from any level on the hourly chart with a target of 1.1374–1.1380 and higher.

Fibonacci levels are drawn from 1.1574–1.1066 on the hourly chart and from 1.1214–1.0179 on the 4-hour chart.