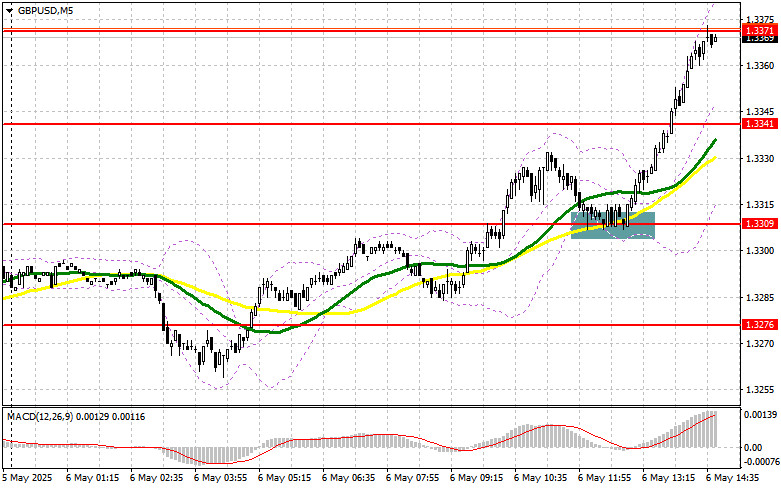

In my morning forecast, I drew attention to the 1.3309 level and planned to make market entry decisions based on it. Let's take a look at the 5-minute chart and analyze what happened. The formation of a false breakout around 1.3309 provided a good entry point for long positions, resulting in a rise of the pair by more than 70 points. The technical picture was revised for the second half of the day.

To open long positions on GBP/USD:

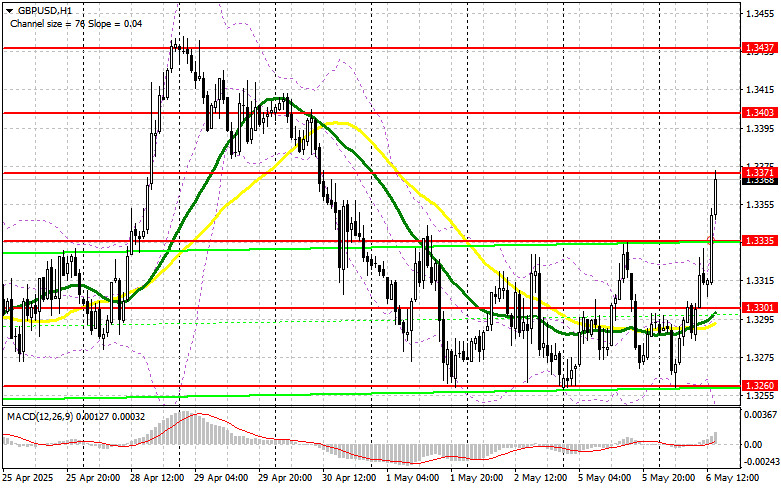

Strong UK services PMI data triggered renewed buying of the pound, allowing the pair to break out of the sideways channel and opening the way to revisit last month's highs. Weak U.S. data could support this move. This afternoon, trade balance and economic optimism index figures are expected. Poor results will be another reason to buy the pound and extend the bull market.

In case of a decline, I prefer to act in the area of the new support at 1.3335, formed in the first half of the day. A false breakout there will give a good entry point into long positions with a target at the 1.3371 resistance, where trading is currently concentrated. A breakout and retest of this range from top to bottom will offer another entry point for long positions, aiming for an update to 1.3403, reinforcing the bullish trend. The furthest target will be 1.3437, where I plan to take profit.

If GBP/USD declines and bulls show no activity at 1.3335 in the second half of the day, pressure on the pound will return. In this case, only a false breakout near 1.3301 will provide a suitable condition to open long positions. I plan to buy GBP/USD immediately on a rebound from the 1.3260 support with a target of a 30–35 point intraday correction.

To open short positions on GBP/USD:

Sellers have not shown themselves so far. In case of another upward surge in GBP/USD after weak U.S. data (which is likely), I will only act after a false breakout near the 1.3371 resistance, where trading is currently taking place. This will provide a sell entry point with a target at the 1.3335 support. A breakout and retest from below of this range will trigger stop orders, opening the way to 1.3301, where the moving averages—favoring bulls—are located. The furthest target will be 1.3260, where I plan to take profit.

If demand for the pound remains strong this afternoon, which it likely will, and bears don't act near 1.3371, then it's better to delay selling until the 1.3403 resistance is tested. I'll only open short positions there on a false breakout. If there's no downward move there either, I will look for shorts from the 1.3437 area, aiming for a 30–35 point correction.

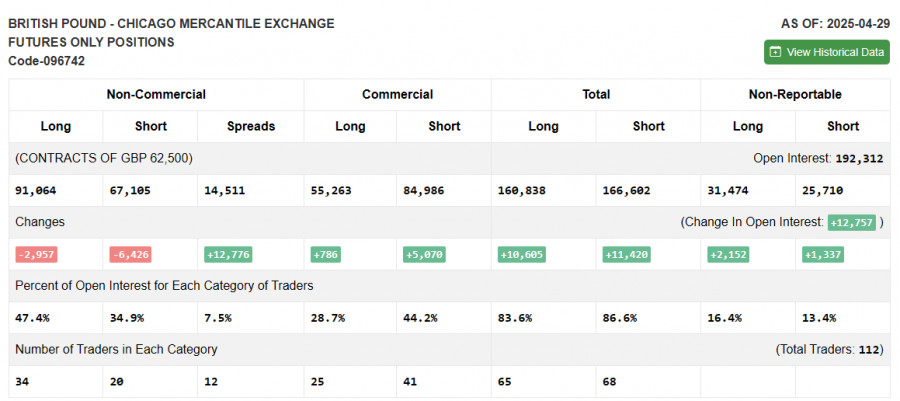

The COT (Commitments of Traders) report for April 29 showed a decline in both long and short positions. Since the Bank of England is not expected to lower interest rates further—just like the Federal Reserve—traders are likely to focus on new fundamental data to gauge the state of the UK economy and the impact of Trump's new tariffs. The latest COT report showed that long non-commercial positions fell by 2,957 to 91,064, while short non-commercial positions dropped by 6,426 to 67,105. As a result, the gap between long and short positions increased by 12,776.

Indicator Signals:

Moving Averages: Trading is taking place above the 30- and 50-period moving averages, indicating continued pound strength.

Note: The author evaluates the period and prices of moving averages based on the H1 hourly chart, which differs from standard D1 daily chart definitions.

Bollinger Bands: In case of a decline, the lower band near 1.3260 will act as support.

Indicator Descriptions:

- Moving Average (MA): Smooths volatility and noise to define the current trend. Period 50 (yellow), Period 30 (green).

- MACD (Moving Average Convergence/Divergence): Fast EMA – period 12, Slow EMA – period 26, Signal SMA – period 9.

- Bollinger Bands: Period – 20.

- Non-commercial traders: Speculators such as retail traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain criteria.

- Long non-commercial positions: Total long open positions held by non-commercial traders.

- Short non-commercial positions: Total short open positions held by non-commercial traders.

- Total non-commercial net position: The difference between non-commercial short and long positions.