Market Expectations Shift Slightly

The probability of a rate cut as early as July rose to 21.2 percent, up from 18.6 percent the previous day, according to CME Group's FedWatch tool — reflecting cautious optimism among investors.

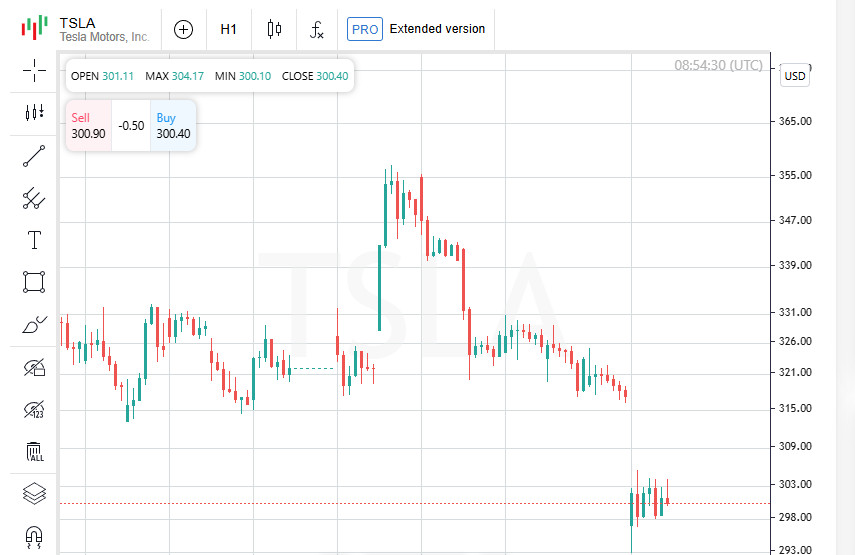

Mixed Signals from Wall Street

The Dow Jones managed a solid advance, rising nearly one percent. But the broader market failed to keep pace. The S&P 500 and Nasdaq retreated from Monday's all-time highs, dragged down in part by a sharp drop in Tesla shares. The 4 percent decline followed comments from former President Donald Trump, who threatened to cut billions in federal subsidies received by Elon Musk's company.

Closing Market Snapshot:

- Dow Jones Industrial Average rose by 400.17 points (up 0.91%) to 44,494.94;

- S&P 500 fell by 6.94 points (down 0.11%) to 6,198.01;

- Nasdaq Composite dropped 166.84 points (down 0.82%) to 20,202.89.

Markets Waver as Tariff Fears Resurface

Global equities edged lower on Tuesday amid renewed investor concerns over the impact of potential tariffs on worldwide economic growth. The MSCI World Index dipped by 0.05 percent to settle at 917.42, while the pan-European STOXX 600 fell by 0.21 percent. These moves come as markets await the July 9 deadline set by Donald Trump, which could bring new trade restrictions into play.

US Manufacturing Still Contracting

Economic signals from the United States painted a cautious picture. According to the Institute for Supply Management (ISM), manufacturing activity remained in contraction territory in June, continuing a trend of sluggish output in the industrial sector.

JOLTS Report: More Jobs, But Caution Lingers

Fresh labor market data from the Job Openings and Labor Turnover Survey (JOLTS) showed a significant jump in job openings, rising by 374,000 to a total of 7.769 million by the end of May. However, subdued hiring levels suggested that the broader labor market might be losing momentum.

All Eyes on Government Payroll Data

Attention now turns to the upcoming employment report, scheduled for Thursday — one day earlier than usual due to the Independence Day holiday. This release is expected to be a key driver in shaping forecasts for future Federal Reserve rate cuts.

Bond Yields Reverse Course, Head Higher

In response to the latest data, yields on US Treasury securities rose. The benchmark 10-year yield increased by 2.3 basis points, reaching 4.25 percent. Meanwhile, the 2-year yield — often seen as a barometer of interest rate expectations — climbed by 5.8 basis points to 3.779 percent.

Trump's Tax Bill Clears Senate Hurdle

Donald Trump's legislative proposal to slash taxes and curb federal spending has cleared a significant milestone. The Senate narrowly passed the bill, sending it back to the House of Representatives for final approval. With both chambers under Republican control, the legislation is expected to face little resistance.

Dollar Decline Extends to Nine Sessions

The US dollar index, which tracks the greenback against a basket of major currencies, continued its downward trend, posting its longest losing streak since 1973. The index edged down by 0.02 percent to 96.74 in its latest reading, marking its ninth consecutive session of decline.

Euro and Pound Edge Higher

While the dollar struggles, the euro and British pound showed resilience. The euro gained 0.06 percent, reaching 1.1793, and the pound rose by 0.04 percent to trade at 1.3739.

Yen Strengthens as Safe Haven Demand Grows

The dollar also slipped against the Japanese yen, losing 0.27 percent to stand at 143.62. Investors appear to be shifting into safe-haven assets amid persistent global trade uncertainty.

Japan Shows Economic Resilience

Japan's economy is signaling strength despite external challenges. The latest Tankan business sentiment index from the Bank of Japan suggested that Asia's third-largest economy is holding steady. A separate private-sector survey added to the optimism, showing the country's manufacturing activity expanded in June for the first time in over a year.

Oil Prices Rise on Global Optimism

Crude oil prices gained ground. West Texas Intermediate rose by 0.52 percent to 65.45 dollars per barrel, while Brent crude advanced 0.55 percent to settle at 67.11 dollars.

European Markets Open on a Positive Note

Stock markets across Europe started the day with modest gains. The STOXX 600 index climbed 0.3 percent to reach 542.03 points as of 07:10 GMT. Other major regional indexes also traded in positive territory.

Trump Sets Firm Trade Deadline

On Tuesday, former US President Donald Trump made it clear he has no plans to extend the July 9 deadline for nations to reach new trade agreements with Washington. While expressing hope for a deal with India, he remained skeptical about achieving similar progress with Japan.

EU's Trade Chief Heads to Washington in Bid to Avoid Tariff Clash

This week, the European Union's top trade official is expected to arrive in Washington for critical talks aimed at defusing tensions over potential new US tariffs. The visit is seen as a strategic move to preserve fragile transatlantic economic ties and prevent further disruption to global trade flows.

Mining and Banking Stocks Lift European Markets

European stock exchanges opened in positive territory. Shares of mining companies rose by 1.4 percent, while the banking sector advanced 1.3 percent. The uptick reflects cautious investor optimism fueled by diplomatic efforts and improving corporate sentiment.

EU Shuts Door on UK Trade Bloc Request

According to reporting by the Financial Times, the EU has blocked a move by the British government to join a pan-European trade group. The rejection underlines continued strain in UK-EU relations in the post-Brexit landscape and signals Brussels' firm stance on regional integration.

All Eyes on Eurozone Jobs Data

Later today, the eurozone is set to release its unemployment figures for May. The labor market update will be closely watched by economists and policymakers, as it could influence expectations around future moves by the European Central Bank.

Trump Tax Plan Narrowly Passes in Senate

In Washington, Senate Republicans on Tuesday passed a sweeping tax and spending bill backed by Donald Trump. The legislation now heads to the House of Representatives for a final vote. The bill marks a major legislative step forward for the former president's economic agenda.

Spectris Shares Soar on KKR Buyout Offer

UK-based scientific instruments firm Spectris saw its stock jump by 5.1 percent after accepting an improved takeover bid from American private equity firm KKR. The deal highlights continued momentum in transatlantic mergers and acquisitions.