Tesla leads rally as S&P 500 climbs

The S&P 500 wrapped up Tuesday's trading session in positive territory, bolstered by a strong surge in Tesla shares. Investor sentiment turned optimistic amid renewed hopes for constructive progress in U.S.–China trade negotiations aimed at resolving a long-standing tariff standoff that has rattled global markets throughout the year.

Cautious optimism in trade talks

Although a preliminary trade accord was signed last month, tensions resurfaced when Washington accused Beijing of restricting exports of rare earth elements — materials critical to the aerospace, semiconductor, and defense industries.

Deal could be close — or delayed

U.S. Commerce Secretary Howard Lutnick described the talks as moving in the right direction and expressed hope they could wrap up by Tuesday evening. However, he warned discussions might continue into Wednesday.

Tech giants split directions

Wall Street's top tech names showed mixed results. Tesla soared 5.6%, while Microsoft edged down 0.4%. Alphabet advanced 1.4% following analyst reports suggesting OpenAI is looking to tap into Google's cloud services to meet growing computational demands.

U.S. stock indexes close higher across the board

Tuesday's trading session ended in the green for all major U.S. stock benchmarks:

- S&P 500 rose 0.55%, closing at 6038.81 points;

- Nasdaq Composite gained 0.63%, ending at 19714.99 points;

- Dow Jones Industrial Average added 0.25%, reaching 42866.87 points.

Energy sector takes the lead

Out of the S&P 500's 11 sectors, 10 posted gains. The energy sector outperformed the rest with a 1.77% climb, followed by a 1.19% increase in consumer discretionary stocks.

Inflation data on deck

Investors are now eagerly awaiting Wednesday's U.S. Consumer Price Index release, which is expected to shed light on the Federal Reserve's next interest rate move.

World Bank trims global outlook

The World Bank downgraded its 2025 global growth forecast by 0.4 percentage points, bringing it down to 2.3%. The revision comes amid rising tariffs and deepening geopolitical uncertainty, which the Bank says are major drags on economic momentum worldwide.

Winners and losers on earnings news

Shares of Insmed skyrocketed nearly 29% after the biotech company announced that its experimental treatment significantly reduced pulmonary pressure and improved physical performance in a mid-stage clinical trial.Conversely, J.M. Smucker took a sharp hit, plunging 15.6%, after its annual earnings guidance fell short of Wall Street expectations.

Snap joins the wearables race

Snap Inc. slipped 0.1% following the company's announcement that it plans to launch its first consumer smart glasses next year — a move that could intensify competition with Meta (banned in Russia) in the wearables market.

Bond investors eye inflation and auctions

Fixed-income traders remained cautious ahead of key U.S. inflation data that could reveal early effects of tariffs on consumer prices. Markets were also focused on an upcoming Treasury auction, seen as a litmus test for demand amid rising macroeconomic uncertainty.

U.S.-China deal framework agreed

In London, negotiators from Washington and Beijing announced progress in trade talks, stating they had reached a framework for a potential agreement. The document is now being sent to the heads of state for further evaluation and potential approval.

Courts uphold Trump-era tariffs

Adding another wrinkle to the trade narrative, a federal appeals court ruled to maintain the sweeping tariffs introduced during Donald Trump's presidency - at least temporarily - while it reviews a lower court decision aimed at blocking them. This move introduced further legal complexity for market participants.

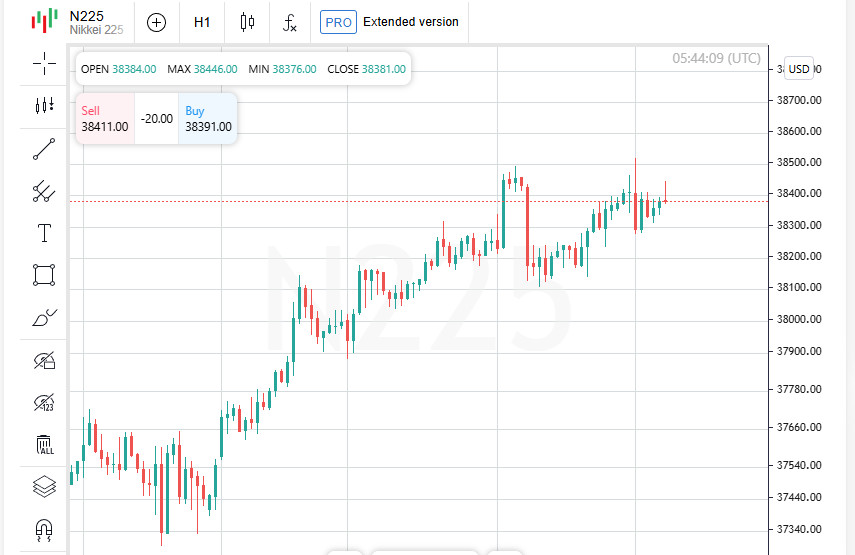

Asian markets tread lightly upward

Equities in the Asia-Pacific region posted modest gains. The broad MSCI index excluding Japan edged up 0.2%, while Japan's Nikkei rose 0.4% and Australia's ASX 200 also ticked up 0.4%.

European and U.S. futures slide slightly

Futures markets signaled a cautious start in Europe and the U.S.:

- EUROSTOXX 50 - down 0.2%;

- FTSE - down 0.2%;

- DAX - down 0.2%;

- S&P 500 futures - down 0.1%;

- Nasdaq futures - down 0.1%.

Muted moves in currency trading

Currency markets remained relatively stable. The U.S. dollar slipped 0.1% against the Japanese yen to 144.73, while the euro edged up to $1.1433. The U.S. Dollar Index held flat at 98.971.

Gold climbs, oil retreats from highs

Commodities showed mixed signals: gold rose 0.3%, trading at $3333 per ounce. Oil prices pulled back slightly after nearing seven-week highs, ahead of U.S. inventory data:

- Brent crude dipped 31 cents to $66.56 per barrel;

WTI crude fell 28 cents to $64.71 per barrel.