U.S. stock indexes ended lower on Thursday, with the Nasdaq losing more than 1% and tech stocks leading the decline after a disappointing outlook from Salesforce.

Investors also weighed data showing the U.S. economy grew more slowly than expected in the first quarter. A separate report showed weekly jobless claims rose more than expected. Salesforce (CRM.N) shares fell 19.7% a day after the company forecast second-quarter profit and revenue below market expectations, citing weak customer spending on its cloud and enterprise products.

The S&P 500's technology sector (.SPLRCT) fell 2.5%, leading the decline in the benchmark index. The communications services sector (.SPLRCL) fell 1.1%, while other S&P 500 sectors ended the day higher.

The Commerce Department's report showed that first-quarter economic growth was revised down as consumer spending and equipment investment slowed, as well as a key inflation measure fell ahead of the April personal consumption expenditure report.

"Typically, a downward revision to GDP would be expected to lift the market, as it would signal that the economy is slowing and signal that the Fed has accomplished its mission, which could lead to rate cuts. "But today we're seeing a different reaction," said Mark Hackett, head of investment research at Nationwide. "I'm a little surprised, but not too surprised, given that after six weeks of rallying, the situation looks pretty healthy.

The expectation is that we'll see some consolidation or sideways movement in the market in the near term." The S&P 500 (.SPX) fell 31.47 points, or 0.60%, to end the session at 5,235.48. The Nasdaq Composite (.IXIC) lost 183.50 points, or 1.08%, to end at 16,737.08.

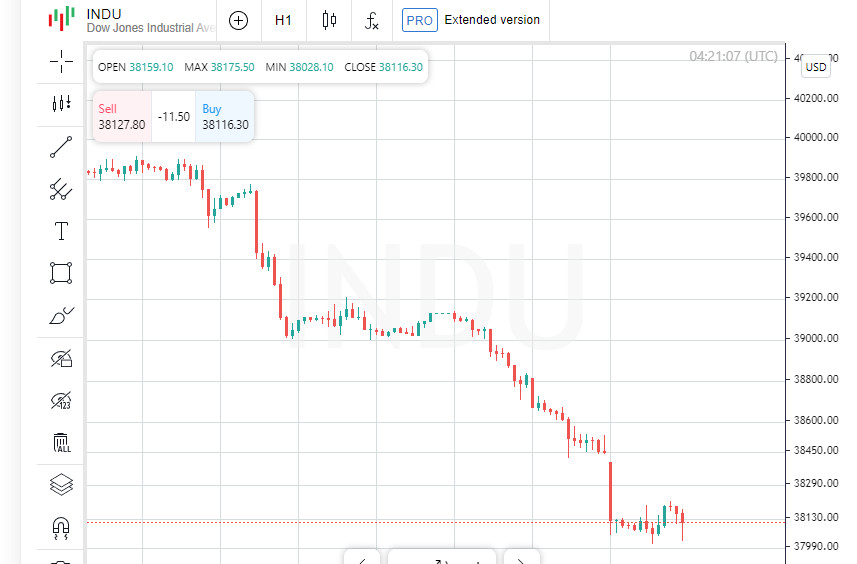

The Dow Jones Industrial Average (.DJI) fell 330.06 points, or 0.86%, to 38,111.48. U.S. Treasury yields fell after the data, while the chance of a rate cut of at least 25 basis points in September rose to 50.4% from 48.7%, according to CME's FedWatch tool. Bond yields hit multi-week highs earlier in the week.

In after-hours trading, Dell Technologies (DELL.N) shares fell more than 12% after the company reported its quarterly results. The stock ended the session down 5.2%.

HP (HPQ.N) shares rose 17% in the regular session after second-quarter revenue beat expectations. Tesla (TSLA.O) shares added 1.5% after it said it was preparing to register its self-driving software in China.

Best Buy (BBY.N) shares jumped 13.4% after the company beat quarterly profit estimates. Meanwhile, shares of department store chain Kohl's (KSS.N) fell 22.9% after cutting its full-year sales and profit forecasts.

Advancing stocks outnumbered decliners 2.57-to-1 on the NYSE and 1.41-to-1 on the Nasdaq. The S&P 500 posted 14 new 52-week highs and 10 new lows, while the Nasdaq Composite posted 51 new highs and 95 new lows.

U.S. exchanges reported trading volume of 12.10 billion shares, slightly below the 20-day average of 12.39 billion shares.

The U.S. economy grew more slowly than expected in the first quarter, according to a Commerce Department report that showed consumer spending weakened. Gross domestic product increased 1.3% year-over-year, compared with initial estimates of 1.6%.

The U.S. dollar index weakened after hitting a two-week high the day before. U.S. Treasury yields also fell Thursday after two days of gains on weak debt auction results.

"The initial reaction to the data was that the likelihood of a Fed rate cut has increased as the slowdown in the economy and consumption could help ease inflation," said Chris Zaccarelli, chief investment officer at Independent Advisor Alliance. However, he views rates as one of many factors weighing on the market.

The MSCI World Equity Index (.MIWD00000PUS) was down 3.22 points, or 0.41%, at 780.94.

While investors digested the GDP data, they were eagerly awaiting Friday's April report on the core U.S. personal consumption expenditures (PCE) price index, a key inflation gauge for the Fed.

Earlier in Europe, the STOXX 600 (.STOXX) rose 0.6% after a big drop on Wednesday, driven by data showing German inflation rose more than expected in May. Investors were eyeing key euro zone inflation data due on Friday.

The yield on 10-year U.S. Treasury notes fell 7.6 basis points to 4.548%, from 4.624% late Wednesday. The yield on 30-year notes fell 6.3 basis points to 4.6814% from 4.744%, and the yield on 2-year notes, which typically reflects interest rate expectations, fell 5.6 basis points to 4.929% from 4.985%. In the foreign exchange market, the dollar index, which measures the dollar against a basket of currencies including the yen and the euro, fell 0.34% to 104.77.

The euro gained 0.26% to $1.0828, while the dollar weakened 0.47% against the Japanese yen to 156.86 yen.

In energy, oil prices fell for a second day after the U.S. government reported weak fuel demand and an unexpected increase in gasoline and distillate inventories.

U.S. crude fell 1.67% to $77.91 a barrel, while Brent crude futures fell 2.08% to $81.86 a barrel. Spot gold prices rose 0.13% to $2,341.94 an ounce, led by lower dollar and Treasury yields.