After witnessing significant market movements in stocks and bonds last week, the start of this week has been relatively calm. The yield on 10-year US Treasury bonds became steady after retreating from the psychological level of 5%. The dollar is trying to regain the initiative, which may prove challenging given the unexpectedly weak economic reports and the market's confidence in the end of the Federal Reserve's rate-hike cycle.

Supporting the notion of the end of the Fed's cycle is the fact that according to the October 2023 Senior Loan Officer Opinion Survey on Bank Lending Practices (SLOOS), over the third quarter, lending standards tightened across all categories of residential real estate loans, and remaining terms and conditions for each type of consumer loan remained basically unchanged, reducing the need for another rate hike.

Trade data from China for October have been mixed. Imports defied expectations with a 3.0% YoY increase against forecast of -4.8%, which may be seen as confirmation of a quick recovery in domestic demand. However, export figures have taken a sharper downturn than anticipated (-6.4% YoY, forecast -3.3%), as tightening financial conditions led to a reduction in global demand. China's import growth overall supports both the New Zealand dollar (NZD) and the Australian dollar (AUD).

Oil prices are trying to stabilize after a period of decline, as Saudi Arabia and Russia confirmed it would continue with its additional voluntary cut of 1 million bpd in December. Given the threat of a global demand reduction, this decision doesn't come as a surprise.

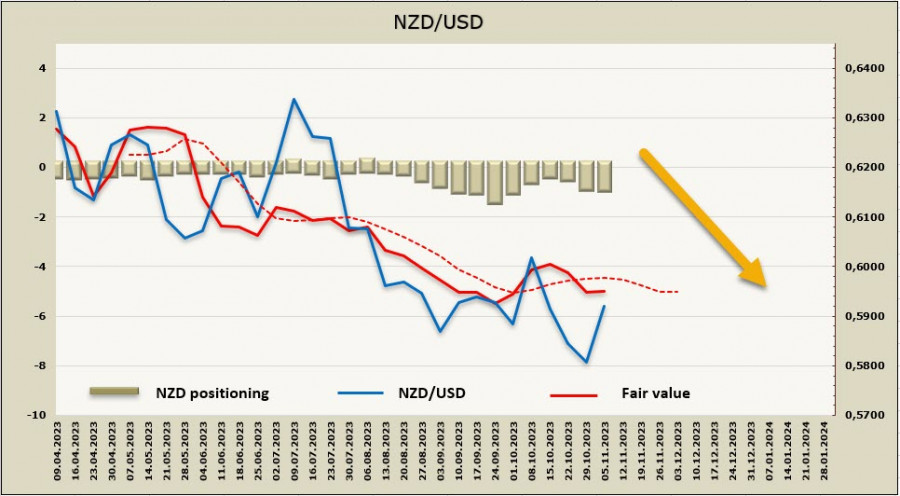

NZD/USD

After the release of the quarterly labor market report earlier this week, there has been no noteworthy economic report from New Zealand. The country recently held elections, a new government is being formed, so some time will be dedicated to consultations between major political forces, and the Reserve Bank of New Zealand is likely to await the results and refrain from taking any actions.

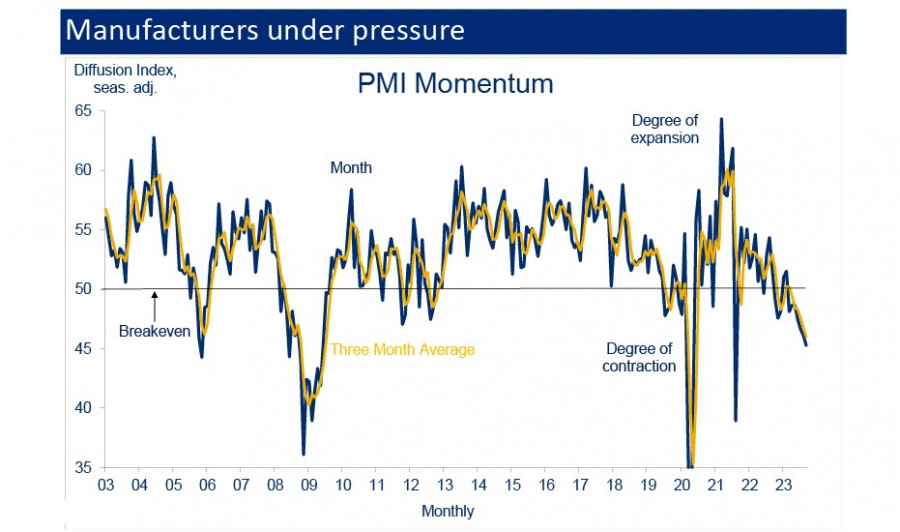

The New Zealand economy dropped back into contraction, with PMI indicators steadily decreasing for six consecutive months.

The RBNZ's expectations review will be published on Wednesday, which is important in terms of prospects for inflation. The RBNZ's previous actions haven't led to significant results, and inflation remains stable at high levels. If the RBNZ confirms this in the review, the market may perceive it as a hint that the rate hike could continue. This is good for the kiwi's exchange rate as it would support yield growth, but it's not favorable for the economy, which is already on the verge of recession. In any case, increased volatility is possible.

Speculative positioning for NZD has remained almost unchanged during the reporting week, with the net short position decreasing by just 4 million to -747 million. The price is below the long-term average, which suggests the possibility of further decline, although there is no strong trend at the moment.

NZD/USD continues to trade within a bearish channel with no signs of intent to break out of it. A week ago, we assumed that the downtrend would remain intact. Although it unexpectedly rose towards the middle of the channel last week, the pair failed to surpass the upper band of the channel. We expect the pair to trade within the bearish channel, with a possibility of another attempt to rise towards the upper band of the channel. To do so, it would need to update the local high of 0.6048 and consolidate above that level. In the long term, the kiwi continues to weaken, it will likely return to the support area of 0.5760/80.

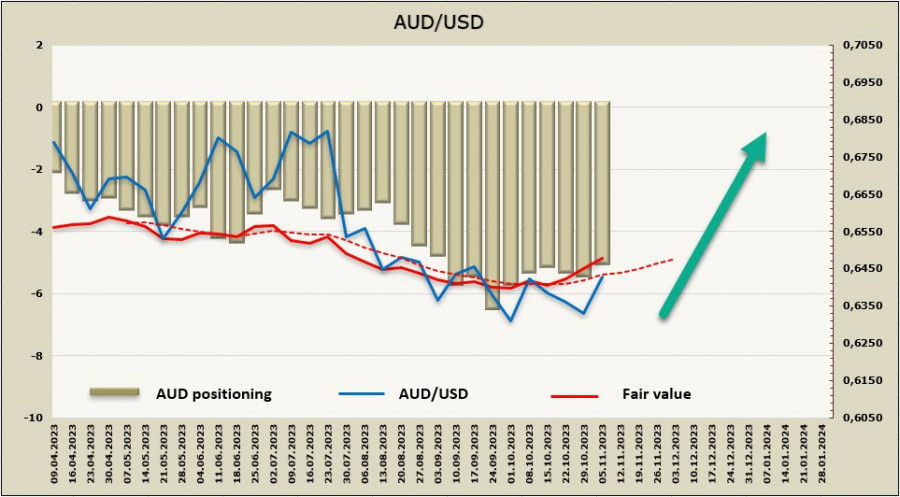

AUD/USD

On Tuesday, the Reserve Bank of Australia raised the interest rate by a quarter of a point to 4.35%, as expected. The increase came after four consecutive holds in previous meetings and was largely forced due to the unexpected rise in inflation in the 3rd quarter. The RBA specifically noted that sustained services inflation increases the risk of price pressures becoming more persistent than expected.

However, the RBA's outlook on inflation was softer than before, as the accompanying statement no longer included the phrase regarding the possibility of further tightening. This is not a definitive end to the rate hike cycle, but it's evident that the RBA will refrain from taking steps in that direction in the coming months.

Markets reacted with a brief rise in the AUD exchange rate, which was short-lived, as the possible rate hike had already been priced in.

The net short AUD position decreased by 520 million during the reporting week, marking the most significant change among all G10 currencies, thereby, coming in at -4.76 billion. The bearish bias remains intact; however, over the past six weeks, there has been a trend toward reducing the number of short positions. The price is above the long-term average and pointing upwards.

AUD/USD managed to climb above the resistance area at 0.6430/50 as indicated the week before, and considering that the price is firmly moving upward, there is a possibility of further gains. In the long term, an attempt to reach the upper band of the channel at 0.6710/30 is likely, while it is less likely for the pair to return to the support area at 0.6270/90.